$177 Million AT&T Settlement: If you’re an AT&T customer—or ever were—there’s some money potentially waiting for you. Thanks to a $177 million settlement in December 2025, AT&T is compensating millions of people impacted by two major data breaches in 2024. Whether your personal info was sold on the dark web or y

our call logs were exposed, you could qualify for up to $7,500. But there’s a catch: you have to file a claim before December 18, 2025.

$177 Million AT&T Settlement

The $177 million AT&T settlement is more than just corporate pocket change—it’s an important moment for consumer justice and data accountability. If your info was leaked (and odds are high), you could get compensated for the inconvenience, risk, and stress of dealing with data breaches.

| Topic | Details |

|---|---|

| Settlement Total | $177 million |

| Deadline to File | December 18, 2025 |

| Max Individual Payout | Up to $7,500 |

| Eligibility | Current and former customers affected by 2024 breaches |

| Claim Portal | telecomdatasettlement.com |

| Final Approval Hearing | January 15, 2026 |

| Claim Types | Documented losses or tiered payouts |

| Customer Base Impacted | Potentially 75M+ individuals |

| Support Hotline | (833) 890-4930 |

What Led to the $177 Million AT&T Settlement?

Let’s rewind to 2024.

AT&T reported two major data breaches:

- March 30, 2024 (AT&T 1) – Sensitive customer data like Social Security numbers, names, account PINs, and email addresses were exposed and began circulating on dark web marketplaces.

- July 12, 2024 (AT&T 2) – This breach involved the exposure of call metadata, including numbers dialed, dates and durations of calls, and in some instances, even cell tower location data.

These breaches didn’t just affect a small subset of customers. They affected millions. By some estimates, over 75 million records were compromised across both breaches.

Naturally, lawsuits followed—and fast. As class actions poured in from across the country, a federal court consolidated the claims. The result: AT&T agreed to settle for $177 million, without admitting wrongdoing.

Who Is Eligible for Compensation?

If you received a notification email, letter, or even a popup on your AT&T app, that means you’re likely eligible.

But even if you didn’t, you may still qualify. Here’s how the eligibility breaks down:

AT&T 1 Class

You’re part of this group if:

- You had an AT&T account in or before March 2024

- Your personally identifiable information (PII) was exposed

This includes:

- Social Security Number (SSN)

- Date of birth

- Billing address

- AT&T account number

- Account PIN

AT&T 2 Class

You’re part of this group if:

- You were a user on an AT&T wireless account during July 2024

- Your call detail records were leaked

This includes:

- Your phone number

- Numbers you contacted

- Call durations

- Call timestamps

- Tower locations in some cases

Dual-Class Eligibility

Some customers are in both classes, meaning they can file two claims and potentially earn the full $7,500—if losses are documented.

How Much Can You Get?

Let’s talk money.

Documented Losses

If you can show that the data breach led to actual, out-of-pocket costs, you may qualify for:

- Up to $5,000 for AT&T 1 breach

- Up to $2,500 for AT&T 2 breach

Examples of valid losses:

- Unauthorized credit card charges

- Identity theft recovery services

- Time lost disputing fraud (calculated hourly)

- Legal or notary fees

- Credit freezes

Tiered Cash Payments (No Receipts Needed)

Don’t have proof of damages? No problem. You may still be eligible for a cash payout:

- Tier 1: SSN exposed = highest tier

- Tier 2: PII exposed, but not SSN

- Tier 3: Call metadata only (lower payout)

Amounts vary based on how many people file, but early estimates suggest payouts between $35 to $200+, and more for Tier 1.

How to File $177 Million AT&T Settlement Claim – Step-by-Step Guide

Filing is free, fast, and simple.

Step 1: Go to telecomdatasettlement.com

This is the only official claim website. Be cautious of scams or fake lookalikes.

Step 2: Locate or Request Your Claim ID

If you didn’t get a letter or email:

- Use the “Resend Claim ID” form on the site

- Call (833) 890-4930 for help

Step 3: Choose Your Claim Type

- Documented Loss: Upload receipts or other evidence

- Tiered Claim: No documentation needed

Make sure to file separate claims if you qualify under both breach incidents.

Step 4: Submit by December 18, 2025

You can:

- File online, or

- Download and mail the form (must be postmarked by deadline)

Why You Should Care (Even if You Left AT&T)?

One of the biggest myths is: “I’m not a customer anymore, so this doesn’t apply to me.”

Wrong.

AT&T, like many companies, retains customer data for years, especially for billing, legal, or regulatory reasons. Even if you ditched them years ago, your data may still have been in their systems—and affected.

If you had any kind of AT&T account in the past decade (including GoPhone, prepaid, family plans, or bundled accounts) you could be eligible.

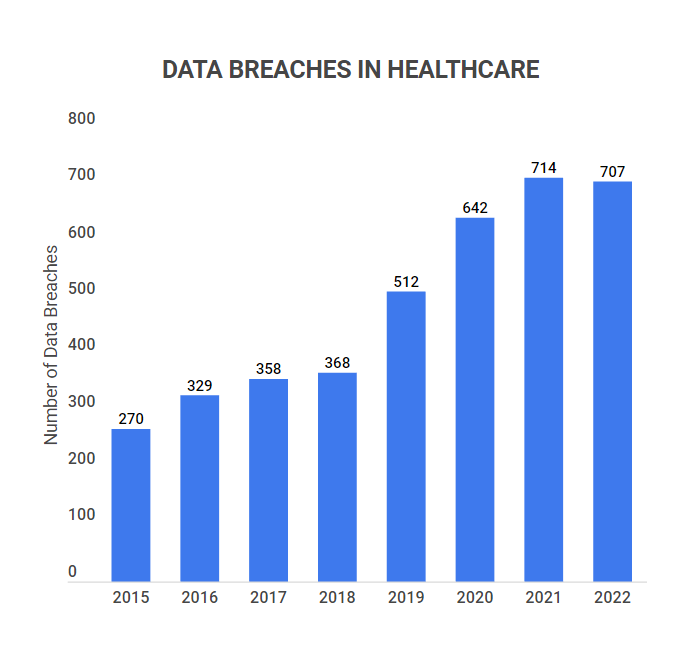

Legal Implications & Consumer Privacy

This settlement highlights an uncomfortable truth: Data privacy in the U.S. is weak.

Unlike Europe’s GDPR, the U.S. has no single, federal data protection law. Instead, consumers rely on:

- The Federal Trade Commission (FTC)

- State-level privacy laws (like California’s CCPA)

- Class-action lawsuits like this one to hold companies accountable

For professionals working in tech, law, or compliance, this case is a wake-up call. Companies storing sensitive customer info need end-to-end encryption, frequent audits, and incident response plans—or they’ll end up paying the price.

Real-Life Example: How One User Lost $1,300

Let’s meet “James,” a 47-year-old freelance photographer from Austin, TX.

In April 2024, he noticed several suspicious credit inquiries on his Experian report. Within a week, someone had opened two credit cards and a personal loan using his information.

James had used AT&T in 2021, but never thought his data was still on file. After reporting the fraud, freezing his credit, and spending hours on calls with banks and credit bureaus, he learned his data was part of the March breach.

His documented losses totaled $1,300—and he’s now submitting a claim.