$5,108 Social Security Payment: Millions of Americans will receive their Social Security checks in December 2025, but there’s a lot of buzz online about a whopping $5,108 payment. This article breaks down exactly who qualifies for that amount, when the payments arrive, and how you can maximize your Social Security benefits now and in the future. Whether you’re a retiree, someone planning for retirement, or helping a loved one navigate Social Security, this guide provides the clarity, resources, and expert-backed advice you need.

$5,108 Social Security Payment

December 2025 brings more than just a monthly check — it’s a chance to reflect on your Social Security strategy. Whether you’re collecting already or still planning, knowing the ins and outs of payment dates, benefit maximums, COLA increases, and claiming strategies can make a big difference in your financial well-being. Remember, $5,108 is not a gift — it’s earned through decades of hard work, smart timing, and planning. If you’re not there yet, don’t worry. Small changes now can set you up for a stronger, more secure retirement.

| Topic | Details |

|---|---|

| Payment Dates | Dec 1 (SSI); Dec 3, 10, 17, 24 (SSA depending on birthday); Dec 31 (early Jan 2026 SSI) |

| Max Monthly Benefit | $5,108 (age 70 retirees with max earnings) |

| Average Retirement Benefit | ~$2,008.31 in 2025 |

| 2026 COLA | 2.8% increase begins January |

| Official Source | ssa.gov |

What Is the $5,108 Social Security Payment?

Let’s be clear: the $5,108 figure is not a bonus, stimulus, or special one-time payment.

It represents the maximum monthly Social Security retirement benefit in 2025, available only to a specific group of high earners who meet all of the following:

- Worked at least 35 years

- Earned at or above the Social Security taxable maximum most of those years (which is $168,600 in 2025)

- Waited until age 70 to begin claiming benefits

For everyone else, benefits are typically much lower. In fact, the average monthly benefit for retired workers in 2025 is about $2,008.31, according to the Social Security Administration’s (SSA) official projections.

December 2025 Social Security Payment Schedule

The SSA pays benefits on a staggered schedule. If you’re new to receiving Social Security, here’s how it works:

- Dec 1: Supplemental Security Income (SSI) only

- Dec 3: Social Security benefits for those who started before May 1997 or receive both SSI and SSA

- Dec 10: Birth dates 1st–10th

- Dec 17: Birth dates 11th–20th

- Dec 24: Birth dates 21st–31st

- Dec 31: SSI January 2026 payment issued early (due to New Year’s Day holiday)

Direct deposit payments usually land early on the scheduled date. Paper checks may take several days longer.

How Social Security Payments Are Calculated?

Your benefit is based on a formula that considers:

- Your lifetime earnings, indexed to account for inflation

- Your 35 highest-earning years

- Your age at the time you begin collecting

The result is a number called your Primary Insurance Amount (PIA). If you retire before full retirement age (FRA), you receive a reduced amount. If you delay until after FRA (up to age 70), you get delayed retirement credits, increasing your benefit by up to 8% per year.

Example:

- Alice retires at 62: receives ~$2,800/month

- Bob retires at 70: receives the maximum of ~$5,108/month

- Carla retires at FRA (67): receives ~$4,000/month

Delaying retirement may not be right for everyone, but the reward is substantial for those who can afford to wait.

COLA in 2026: Long-Term Impacts

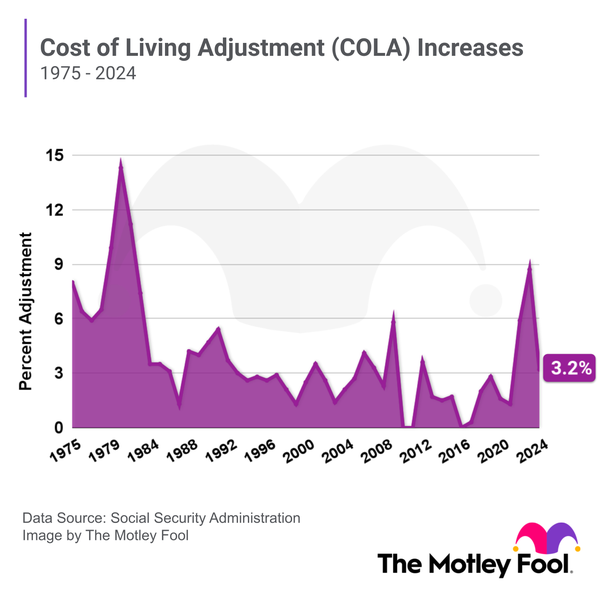

Starting January 2026, beneficiaries will receive a 2.8% Cost-of-Living Adjustment (COLA) to keep pace with inflation.

That means:

- A retiree getting $2,000/month in 2025 will receive about $2,056 in 2026.

- Higher COLA boosts also compound over time, significantly impacting long-term income for those living into their 80s or 90s.

This adjustment is automatic. You don’t need to apply for it. COLA has been added every year since 1975, though the percentages vary with inflation.

How to Maximize Your Benefits?

Here are smart steps to get the most out of your Social Security:

- Work at least 35 years: Shorter work histories reduce your average earnings.

- Earn more (legally): The more you earn (up to the taxable limit), the higher your future benefit.

- Wait until age 70 if possible: Delaying boosts your benefit up to 32% more than claiming at FRA.

- Claim spousal/survivor benefits: Married? Widowed? You may be eligible for additional benefits.

- Check your SSA statement yearly: Log into ssa.gov to confirm your earnings history is correct.

What to Do If Your $5,108 Social Security Payment Is Late?

Delays happen — especially during the holidays. Here’s what to do:

- Wait 3 mailing days after your scheduled date.

- Then call 1-800-772-1213 or visit your local SSA office.

- Consider switching to Direct Deposit via ssa.gov for faster, safer payments.

Debunking Common Myths About Social Security

Myth #1: “Everyone gets $5,000 a month in retirement.”

Fact: Only a small percentage get the max; most people receive around $2,000–$2,400.

Myth #2: “Social Security is going bankrupt.”

Fact: The SSA trust fund is projected to pay full benefits until 2034. Even after that, payroll taxes will cover around 77% of benefits unless Congress acts.

Myth #3: “I can’t work while collecting benefits.”

Fact: You can, but if you’re under FRA, your benefits may be reduced temporarily.

$5,108 Social Security Payment Incoming; Everything You Need to Know for December 10

Goodbye Retirement at 67: Social Security’s New Age Requirement Is Reshaping America’s Future

Federal $2,000 Deposit Arriving in December 2025 – Complete Guide for All Beneficiaries