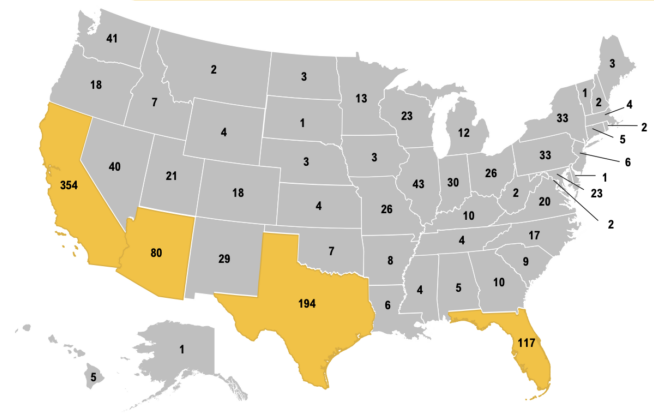

The Denny’s closures planned for 2025 represent one of the most significant contractions in the chain’s modern history. Denny’s Corporation announced that it expects to shutter up to 150 underperforming U.S. restaurants by the end of next year, a move that comes as the 71-year-old brand prepares to go private in a $620 million acquisition deal. Executives say the closings are necessary to stabilize operations amid rising costs, shifting consumer behavior, and a competitive landscape that has changed dramatically since the COVID-19 pandemic.

Iconic Diner Chain

| Key Fact | Detail |

|---|---|

| Number of closures | Up to 150 by end of 2025 |

| Ownership change | Company to go private in $620M deal |

| Main pressures | Declining late-night traffic, higher labor and food costs |

| Franchise impact | Many closures target chronically unprofitable units |

A Major Restructuring Effort for a Legacy Brand

During an investor call earlier this month, Denny’s Corporation confirmed plans for widespread consolidation across the United States. The move follows several consecutive quarters of declining traffic at older locations and rising expenses related to food inflation and wage increases. Executives noted that closures would focus on locations with outdated facilities, long-term declines, or lease agreements that no longer align with profitability goals.

According to Reuters, the shift coincides with a deal in which a consortium led by TriArtisan Capital Advisors, Treville Capital Group, and Yadav Enterprises will take Denny’s private. The agreement allows the company to restructure away from public-market scrutiny, giving leadership room to address challenges that have intensified over the past decade.

Understanding the Forces Behind the Closures

Several structural issues have converged to drive the recent wave of Denny’s closures:

Rising Operating Costs

Denny’s faces higher costs across labor, food, and utilities. The U.S. Bureau of Labor Statistics reports restaurant wages up nearly 20% since 2020, while wholesale egg, beef, and produce prices have fluctuated unpredictably.

Declining Late-Night Demand

Denny’s built its reputation as a 24/7 diner. But according to the National Restaurant Association, late-night dining has dropped sharply since 2020 as remote work, safety concerns, and transportation changes reduced overnight activity.

Aging Locations

Many older restaurants require costly updates to remain competitive. Franchise owners told local outlets that renovations can exceed $1 million for high-traffic stores.

Shifting Consumer Habits

Full-service diners now compete with faster, cheaper alternatives. Breakfast-focused chains and app-based delivery services attract younger consumers who prioritize convenience and customizable menus.

Dr. Helen Cortez, an economist at the University of Nevada, said:

“The traditional 24-hour diner model struggles in today’s high-cost, app-driven dining environment. Denny’s is not alone—many U.S. diner chains face similar pressures.”

Denny’s in Historical Context

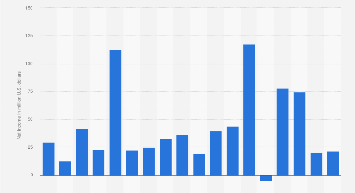

Denny’s began in 1953 as a coffee shop in California and grew into one of America’s best-known diner brands. At its peak in the late 1990s, the chain operated more than 2,500 restaurants. However, the company encountered challenges in the early 2000s, including legal disputes, franchise turnover, and rising competition.

Over the last decade, the chain focused on modernization with mixed results. Menu expansions, remodels, and digital ordering systems helped some markets, but many rural and suburban locations continued to lag behind competitors.

Today, Denny’s operates more than 1,500 locations, a number expected to decline to just over 1,300 after the 2025 closures.

The Competitive Landscape: A Tough Market for U.S. Diner Chains

The decision to initiate large-scale Denny’s restructuring comes at a challenging time for mid-priced, full-service chains. Competitors such as IHOP, Waffle House, and Perkins have also adjusted their footprints, though most have not announced reductions as large as Denny’s.

Industry analysts say diners must now compete not only with traditional rivals but also with:

- Fast-casual breakfast brands

- Drive-thru chains adapting their breakfast menus

- App-based delivery platforms offering all-hours meals

- Meal-prep and grocery delivery services

Michael Grant, a restaurant-sector strategist at Morningstar, explained:

“This is a generational shift. Younger diners view breakfast and late-night meals very differently than past generations. Chains that cannot adapt quickly face steep decline.”

How the Closures Affect Franchise Owners

More than 90% of Denny’s restaurants in the United States are franchised, meaning individual owners shoulder the financial risk of operating costs, renovations, and staffing. Some franchisees support the restructuring, calling it necessary to prevent deeper losses across the system. Others expressed concern about limited support during inflationary periods.

One franchise owner in Louisville, Kentucky, told WLKY News:

“Some of our locations have been operating at a loss for years. We simply cannot keep the doors open without major changes from corporate.”

Several owners said increased rent prices and shifting neighborhood demographics significantly affected profits. In cities where commercial real estate costs have doubled, older diner-style buildings became financially unsustainable.

Impact on Workers and Local Communities

The closures will lead to layoffs at dozens of locations. While the company says affected employees may receive transfer opportunities, availability varies widely by region.

UNITE HERE, a union representing food-service workers, has asked the company to provide transparent transition plans and to support employees seeking new roles within or outside the brand.

Local governments in some states expressed concern about the economic impact on communities where Denny’s serves as a stable employer, particularly in small towns with limited late-night dining options.

Technology, Menu Adjustments, and the Future of Service

As part of its long-term strategy, Denny’s is investing in new digital platforms, simplified menu designs, and upgraded kitchen equipment. The goal is to shorten preparation times and align offerings with trends favoring customizable breakfast items and high-protein meals.

The company is also testing:

- Streamlined menus focused on core breakfast items

- Digital loyalty programs

- AI-powered drive-thru systems in select markets

- Restaurant layouts with expanded takeout counters

These updates mirror broader restaurant industry trends, where digital transformation helps offset high labor costs.

Could Going Private Save the Company?

Analysts remain divided on whether private ownership will stabilize Denny’s. Supporters argue that the move offers several advantages:

- Ability to make long-term investments

- Less pressure from quarterly financial reporting

- Greater freedom to close or relocate stores quickly

- Flexibility to redesign operations and menus

Others say the challenges reflect deeper shifts in American dining patterns, making turnarounds more difficult.

A report from the Brookings Institution notes that restaurant chains dependent on late-night and 24-hour models face “structural decline” due to transportation changes and reduced overnight workforce numbers.

What Comes Next

Even after closures, Denny’s will remain one of the largest full-service diner chains in the United States. The company plans to continue opening new restaurants in select high-growth markets while consolidating older units.

However, the next year will test the chain’s ability to adapt to economic pressures and new consumer expectations. For many customers and franchisees, the closures represent both an end to the familiar and a chance for the company to redefine its place in the modern dining landscape.