Big Fed Announcement Coming: If you’ve been keeping an eye on your savings account, mortgage rate, or the stock market, you’ve probably heard the buzz — a big Fed interest rate announcement is coming December 10, 2025. And everyone from Wall Street traders to your next-door neighbor is wondering: Will the Federal Reserve raise interest rates again — or finally give us a break? Let’s break it all down in plain English. Whether you’re a 10-year-old curious about why adults keep talking about “the Fed,” or a seasoned professional watching bond yields and inflation data like a hawk, this guide explains what’s going on, why it matters, and what it means for your wallet.

Big Fed Announcement Coming

So, will the Fed raise interest rates again on December 10, 2025? All signs point to no. The Federal Reserve is widely expected to cut rates by 0.25%, signaling a pivot toward supporting growth after years of tightening. Inflation has cooled, the job market is softening, and the economy needs a boost — not a brake. Still, this meeting will set the tone for 2026. Powell’s remarks and the Fed’s updated projections will be the real headline. Whether you’re a homeowner, an investor, or just someone watching grocery bills, the Fed’s decisions ripple through every corner of daily life. So buckle up — December 10 isn’t just another date on the calendar. It’s the day we find out whether America’s central bank believes the inflation storm has finally passed.

| Topic | Key Data / Takeaway |

|---|---|

| Meeting Date | December 9–10, 2025 |

| Expected Action | 0.25% rate cut likely |

| Current Rate Range | 3.75% – 4.00% |

| Market Odds of a Cut | 87–89% probability |

| Inflation Level (Oct 2025) | 2.6% (annualized) |

| Unemployment Rate | 4.3% |

| Main Reason for Shift | Slowing job growth, stable inflation |

| What to Watch | Powell’s tone, 2026 projections, inflation outlook |

Why the Big Fed Announcement Coming Meeting Matters?

Every few weeks, the Federal Open Market Committee (FOMC) — the group inside the Federal Reserve that sets interest rates — meets to decide whether to raise, cut, or hold rates steady.

The December meeting is the big one. Think of it as the “season finale” of the Fed’s year — it’s where policymakers summarize their 12-month journey, reveal updated projections, and hint at where rates are heading next.

According to the Federal Reserve’s official calendar, the meeting will conclude on December 10, 2025, with a press conference from Fed Chair Jerome Powell shortly after. What he says — and how he says it — could shape financial markets, mortgages, and savings rates well into 2026.

What’s Going On with Interest Rates?

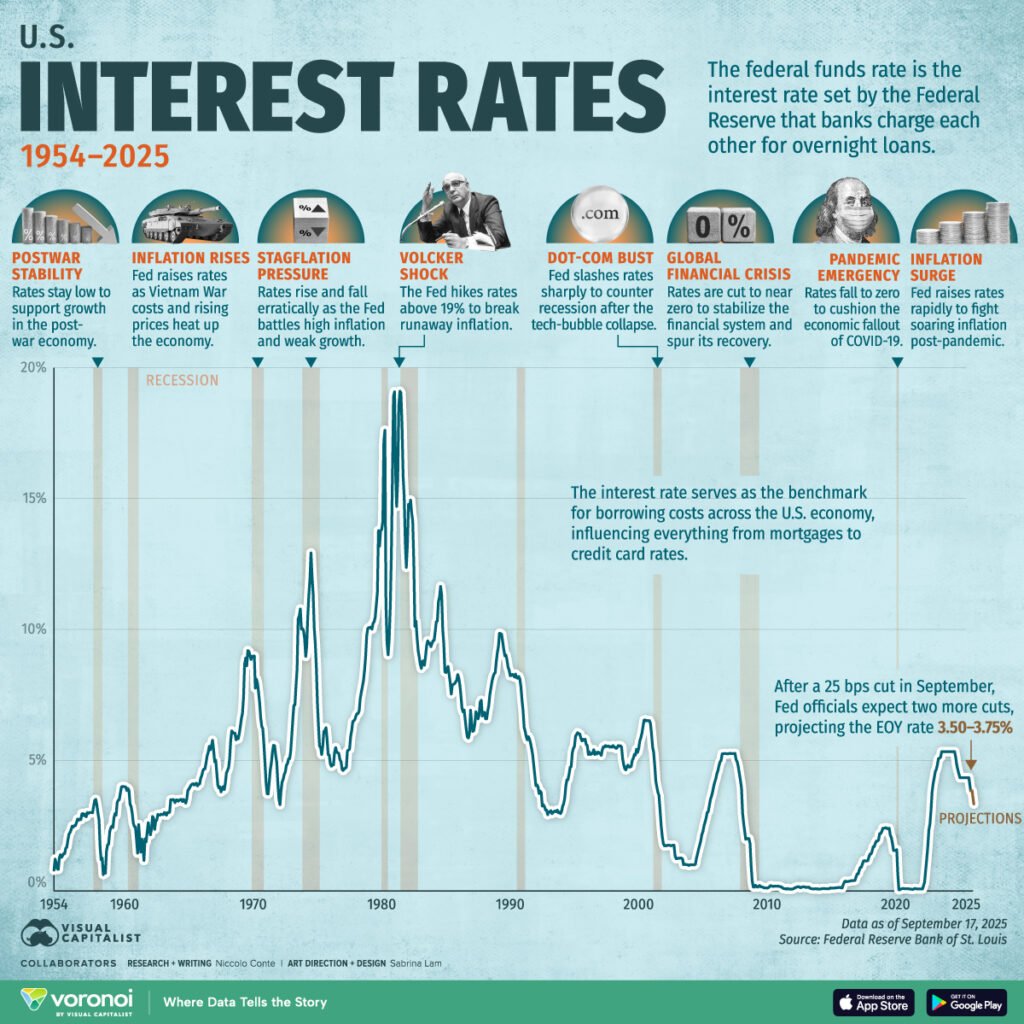

To understand what’s happening now, we need to rewind a bit.

In 2022 and 2023, the Fed was in full battle mode against sky-high inflation. Prices were rising at the fastest pace in 40 years, reaching over 9% in mid-2022. To bring inflation down, the Fed raised interest rates aggressively — 11 hikes in less than two years.

Fast forward to late 2025: inflation has cooled, but the economy has also slowed. The labor market has softened, housing sales are down, and consumer confidence has dipped.

That’s why this December meeting is so critical — it’s the point where the Fed decides whether it’s safe to start easing monetary policy (that is, lowering rates to encourage borrowing and growth).

Most analysts agree that the Fed is leaning toward a 0.25 percentage point cut, which would bring the federal funds rate to 3.50%–3.75%. This would mark the third consecutive rate cut in 2025, following cuts in July and September.

Why the Fed Might Cut Instead of Raise?

The Fed’s main goal is to strike a balance between price stability and maximum employment — what economists call the “dual mandate.” When inflation cools but unemployment starts to creep up, the Fed faces a tough decision: Do they keep rates high and risk a slowdown, or lower them to keep growth going?

Recent data gives us clues:

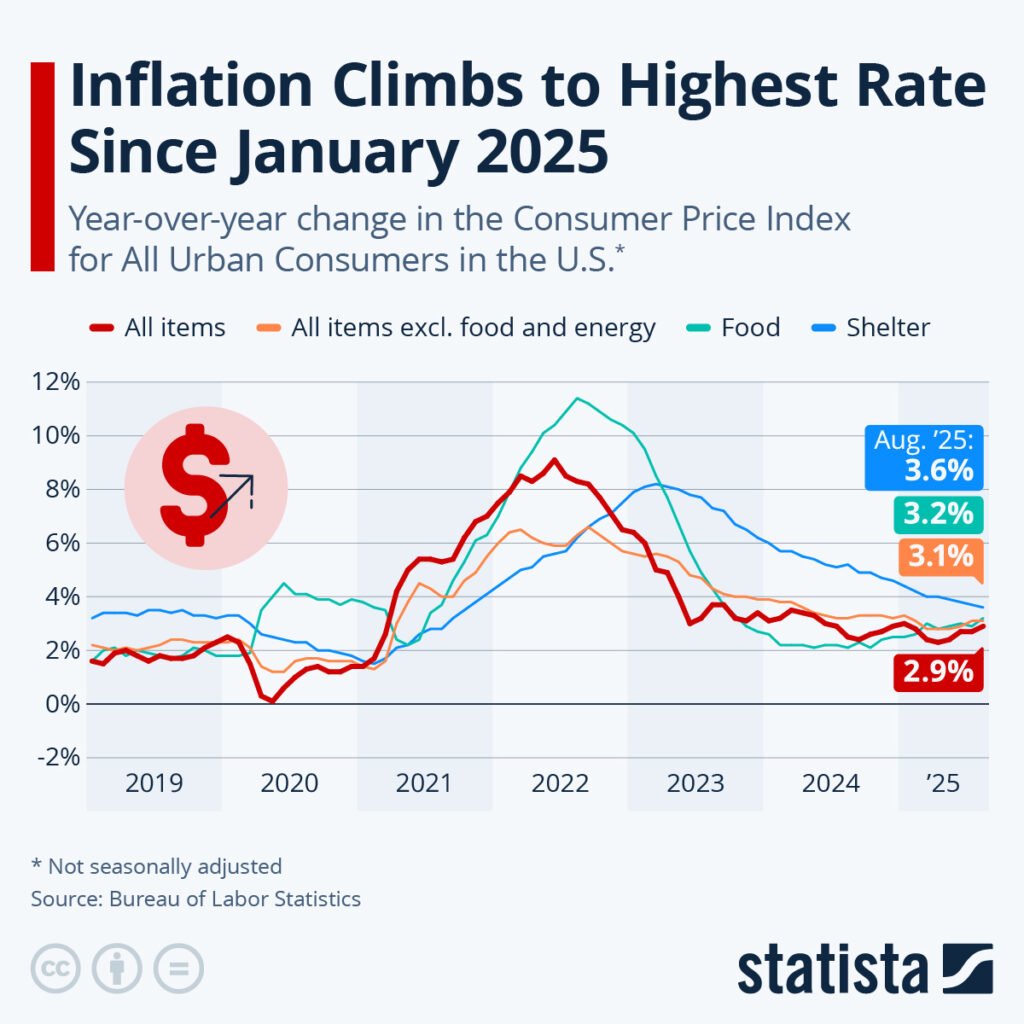

- Inflation: The latest Consumer Price Index (CPI) shows prices rising at 2.6% year-over-year, just slightly above the Fed’s 2% target.

- Job Market: Unemployment has risen to 4.3%, the highest since 2023.

- GDP Growth: The economy expanded at an annual rate of 1.8% in Q3 2025, compared with 2.4% earlier in the year.

These indicators suggest the Fed’s inflation fight is paying off, but now they need to prevent a recession. A small rate cut could give the economy breathing room without reigniting inflation pressures.

What Big Fed Announcement Coming Means for You?

The Fed’s decisions may sound abstract, but they touch nearly every part of your financial life. Here’s how.

If the Fed Cuts Rates (most likely scenario)

- Borrowing gets cheaper. Mortgage rates, car loans, and credit cards may gradually decline, making it easier to borrow or refinance.

- Stocks tend to rise. Lower borrowing costs can boost corporate profits and investor sentiment.

- The U.S. dollar could weaken. A softer dollar helps U.S. exports but can raise the price of imported goods.

- Savings yields may drop. Bank CDs and high-yield accounts could offer smaller returns, so diversifying into bonds or short-term Treasuries might make sense.

If the Fed Raises Rates (unlikely but possible)

- Loans get more expensive. If the Fed shocks the market with a hike, expect higher mortgage and credit costs almost immediately.

- Stock markets might pull back. Higher rates typically make borrowing pricier for companies, which can weigh on share prices.

- Inflation remains tame. A hike would ensure that prices stay under control, but it could risk pushing the economy closer to a stall.

What Experts Are Saying About Big Fed Announcement Coming?

Most economists, banks, and financial research firms are predicting a modest quarter-point rate cut.

- Analysts at Morgan Stanley said they expect “a 25 bps cut as the Fed transitions toward a more neutral stance entering 2026.”

- The Wall Street Journal reported that several FOMC members are open to more cuts in 2026 if inflation remains subdued.

- Reuters estimates that futures markets are pricing in nearly a 90% probability of a rate cut this December.

However, not everyone agrees. Some Fed officials, such as regional presidents in Kansas City and St. Louis, have hinted at caution, warning that cutting rates too soon could risk inflation “snapping back” in 2026.

This internal divide — between hawks (who favor tighter policy) and doves (who favor easing) — is what makes the upcoming meeting particularly intriguing.

How to Prepare: Practical Financial Moves

Here’s how individuals and businesses can prepare for whichever direction the Fed goes.

1. Lock In or Refinance Your Mortgage

If rates drop, mortgage lenders could follow suit. Even a 0.25% cut might lower payments on a $400,000 mortgage by around $50–$100 per month. Use comparison tools like Bankrate’s Mortgage Calculator to model your savings.

2. Pay Down High-Interest Debt

Credit card rates are usually tied to the prime rate, which moves in sync with the Fed’s rate. If you carry balances, now’s a smart time to pay them down or refinance to a lower-interest product before banks adjust.

3. Review Your Investment Mix

Rate cuts often favor growth stocks, tech companies, and real estate investment trusts (REITs), while rate hikes favor value stocks and defensive sectors. Adjust your portfolio carefully and consult a financial advisor before making major moves.

4. Watch Treasury Yields and Bonds

If the Fed cuts rates, bond prices typically rise, and yields fall. Long-term Treasury bonds could see modest gains, while short-term bonds might stabilize. Investors seeking income may want to explore laddered bond portfolios.

5. Businesses: Reassess Credit Lines

For small businesses, lower rates can ease financing costs. It might be a good time to refinance equipment loans or expand credit lines — just be sure to lock in terms before rates shift again in 2026.

The Market’s Reaction So Far

Markets are already positioning for a cut. The S&P 500 has risen about 3% since mid-November, while Treasury yields have declined slightly, signaling investor confidence in a softer Fed stance.

Meanwhile, the U.S. dollar index (DXY) dipped 0.4% over the past week, reflecting expectations of lower interest-rate differentials compared to other central banks like the European Central Bank and the Bank of England.

If Powell’s tone sounds cautious or data-driven rather than overly optimistic, markets may interpret that as a sign the Fed is still wary — which could trigger short-term volatility. But over the long run, investors tend to welcome lower rates as fuel for growth.

New Arrivals at Marshalls: The Coziest, Trendiest & Most Giftable Items for December 2025

VA Cremation Payouts Revealed: How Much Can Your Family Really Get?

Texas SNAP Payments Set for December 8–14 — Check Payment Dates and Eligibility Criteria