Earnings Indicator to FAFSA: When the Department of Education adds an earnings indicator to FAFSA, it’s not just another bureaucratic update — it’s a game-changer for students, parents, and anyone wondering whether college truly pays off. Beginning in December 2025, the U.S. Department of Education (ED) introduced a new feature in the Free Application for Federal Student Aid (FAFSA®) called the “Earnings Indicator.” In plain English, this new system tells you if a college’s graduates earn less than the average high-school graduate in that same state four years after finishing college. If so, FAFSA will flag that college with a “Lower Earnings” warning. It’s not a penalty. It won’t affect your financial aid eligibility. But it’s a powerful reality check — one that may help families make smarter, debt-savvy choices about higher education.

Earnings Indicator to FAFSA

The new FAFSA Earnings Indicator marks a major step toward an honest, data-driven college-choice process. It doesn’t tell you what to do, but it helps you ask smarter questions — before signing on the dotted line for student loans. College is both a personal dream and a financial investment. The more transparent that investment becomes, the better chance students have of achieving both passion and prosperity. Before you submit your FAFSA, take a few minutes to check your colleges on the College Scorecard. It might be the most valuable homework you ever do.

| What Changed | Why It Matters |

|---|---|

| FAFSA now displays a “Lower Earnings” notice for certain colleges. | Helps students evaluate value vs. cost before borrowing. |

| Based on median graduate earnings four years after finishing college. | Measures real-world results, not reputation. |

| Does not affect aid or block applications. | Provides information only — not restrictions. |

| Roughly 2 % of students attend flagged institutions, receiving over $2 billion/year in federal aid. | Highlights the size of low-value programs. |

| Students can cross-check with College Scorecard and FSA Data Center. | Enables independent verification of outcomes. |

Why the Department Added Earnings Indicator to FAFSA?

The Department’s goal is transparency. As Education Secretary Miguel Cardona put it:

“Every student deserves to know the return on investment for their education. We’re making college more transparent — not just more affordable.”

For years, rising tuition and ballooning student-loan debt (now topping $1.7 trillion nationwide) have raised tough questions about whether college is truly worth the cost. The new earnings indicator shines a spotlight on that question with hard data rather than marketing slogans.

It’s part of a broader push toward accountability in higher education — holding institutions responsible for the real-world success of their graduates.

What the Earnings Indicator to FAFSA Actually Does?

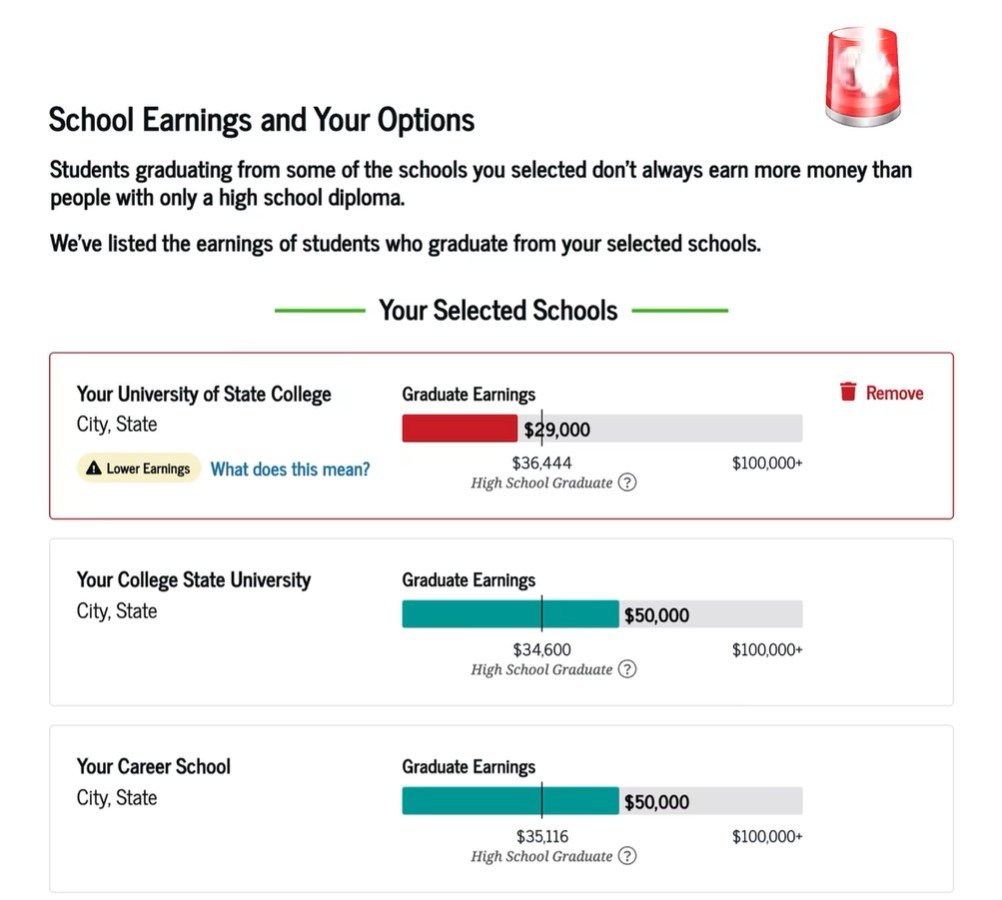

After you submit your FAFSA, you’ll receive a FAFSA Submission Summary (FSS). If any of your listed schools have graduate earnings below those of local high-school graduates, a yellow “Lower Earnings” message appears next to that college’s name.

That’s it. You’ll still get your Pell Grants, loans, and scholarships as usual. The warning is informational, designed to prompt reflection — not rejection.

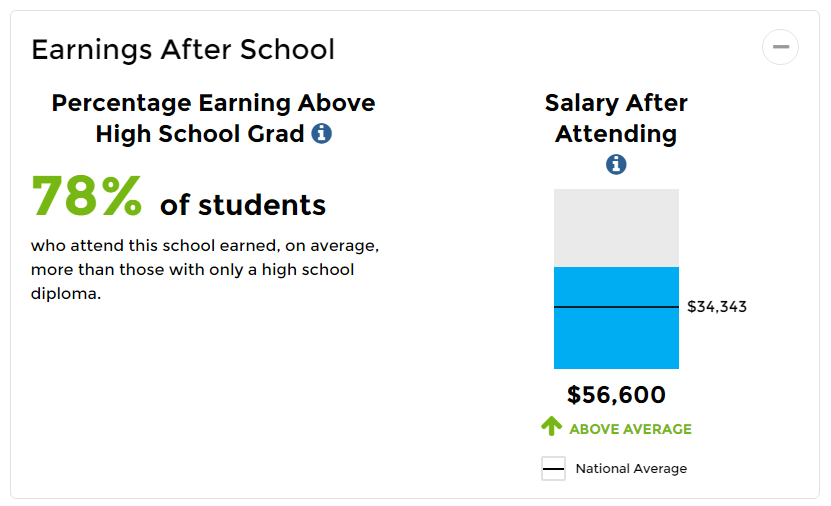

The underlying data come from the College Scorecard, which tracks verified IRS earnings of former students, adjusted for inflation to June 2025 dollars.

Real Example: What a “Lower Earnings” Flag Means

Imagine two schools you’re considering:

- Bright Tech Institute – a for-profit career school where grads earn a median of $29,000 four years after finishing.

- State University Midwest – a public institution whose grads earn $52,000 after four years.

If the median high-school grad in that state earns $34,000, FAFSA will flag Bright Tech Institute but not State University Midwest.

That doesn’t automatically mean Bright Tech is “bad.” Maybe it offers a niche program or lower tuition. But it does mean you should ask hard questions:

- Are graduates finding stable work?

- What’s the total cost versus expected salary?

- Would community college or state-school options offer better value?

Step-by-Step: How to Use the Earnings Indicator to FAFSA

1. Complete Your FAFSA

Enter your financial information, list your schools, and submit as normal.

2. Wait for the FAFSA Submission Summary

Within days or weeks, you’ll receive an electronic FSS detailing your eligibility and listed colleges.

3. Look for the “Lower Earnings” Warning

If a school’s flagged, the warning will appear directly beside the institution name.

4. Explore the Data

Click the notice to view detailed median earnings, compared to statewide high-school averages.

5. Research Further

Visit the College Scorecard for program-specific outcomes, debt levels, and graduation rates.

6. Reconsider Your Choices

If a school’s warning gives you pause, look for alternatives — maybe an in-state public university or community college with stronger ROI.

Pros and Cons of the Earnings Indicator

| Pros | Cons / Limitations |

|---|---|

| Promotes transparency about post-grad outcomes. | Data apply to entire institutions, not majors. |

| Encourages responsible borrowing and informed decisions. | Doesn’t predict individual success or career growth. |

| May pressure colleges to improve job placement. | Could unfairly stigmatize schools serving lower-income populations. |

| Adds a new layer of accountability to federal aid. | Measures earnings only four years out, missing long-term trajectories. |

How This Fits the Bigger Picture?

The “Lower Earnings” flag isn’t a random experiment. It’s part of the Department’s wider Accountability Framework that includes Gainful Employment rules and expanded College Scorecard reporting. Together, these policies aim to ensure that taxpayer-funded aid supports programs leading to economic mobility, not just enrollment numbers.

In practice, this could eventually influence federal funding decisions. If certain institutions consistently produce low-earning graduates, policymakers may question whether they deserve ongoing access to Pell Grants or federal loans.

That’s why many higher-ed leaders view the indicator as both a warning shot and an opportunity — a nudge toward stronger career support, better advising, and more employer partnerships.

The Data Story: What’s Behind the Numbers

According to the Bureau of Labor Statistics (BLS):

- Bachelor’s degree holders aged 25–34 earn a median $59,600.

- High-school graduates earn about $36,600.

Yet, the Education Department’s internal analysis found that at nearly one in five U.S. colleges, median graduate earnings were below $35,000 four years after completion.

This gap reveals how dramatically outcomes can vary — not just between majors, but between institutions.

Practical Advice for Students and Families

1. Don’t panic over the warning.

Some programs (arts, education, nonprofit work) have naturally lower early earnings but strong long-term value.

2. Do your homework.

Compare schools on College Scorecard. Look at major-specific data, not just overall figures.

3. Ask smart questions.

Talk to financial-aid officers and alumni. Ask about average debt, job-placement rates, and internship opportunities.

4. Think about return on investment.

If your expected salary won’t comfortably cover loan payments, reconsider your borrowing amount or look for lower-cost paths.

5. Combine data with passion.

Numbers matter, but purpose does too. The goal is balance — finding a college that matches both your career ambitions and your wallet.

Expert Perspectives

The National Association of Student Financial Aid Administrators (NASFAA) called the change “a healthy step toward informed consumer choice.” President Justin Draeger emphasized:

“Students have a right to know the financial outcomes tied to their college choice. Information empowers — but it shouldn’t intimidate.”

Meanwhile, student advocates urge the Department to go further — pushing for program-level data for every college and stronger connections between FAFSA, Scorecard, and job-market insights from the Bureau of Labor Statistics.

How Colleges Might Respond?

Colleges receiving “Lower Earnings” flags may:

- Re-evaluate curricula to align with high-demand job markets.

- Strengthen career services, internships, and employer pipelines.

- Lower tuition or expand need-based aid to maintain competitiveness.

This could gradually shift the higher-ed landscape toward value-driven education, rewarding schools that deliver measurable outcomes instead of mere prestige.

Step-by-Step: How to Use the College Scorecard

- Go to CollegeScorecard.ed.gov.

- Enter the school name or program.

- Click “Earnings” under “After Graduation.”

- Review median salaries, debt levels, and completion rates.

- Compare several colleges side-by-side before finalizing your FAFSA list.

Texas SNAP Payments Set for December 8–14 — Check Payment Dates and Eligibility Criteria

VA Cremation Payouts Revealed: How Much Can Your Family Really Get?

New Arrivals at Marshalls: The Coziest, Trendiest & Most Giftable Items for December 2025

What This Means for the Future?

In the coming years, the earnings indicator may become just one piece of a much bigger transparency puzzle. With public scrutiny of student-debt crises at an all-time high, policymakers could use these data to influence funding, accreditation, and even recruitment practices.

For families, it means the FAFSA experience is no longer just about financial eligibility — it’s about financial foresight.