Federal $2,000 Deposit Arriving: If you’ve heard someone say, “The government’s giving everyone $2,000 this December,” you’re not alone. Social media has been buzzing with claims about a Federal $2,000 Deposit Arriving in December 2025 — supposedly a new relief payment, stimulus check, or “tariff dividend.” The rumor sounds almost too good to be true — and that’s because, as of now, it is. In this detailed guide, we’ll break down what’s really happening, where the talk came from, and what you should do if you’re seeing messages about an incoming payment. We’ll keep it plain, factual, and easy to understand, whether you’re a young student or a professional following economic policy.

Federal $2,000 Deposit Arriving

The Federal $2,000 Deposit Arriving in December 2025 is not an official government payment. It’s a proposal, not a policy. No law has been passed, no funding allocated, and the IRS has issued no confirmation. While the idea resonates — especially in tough economic times — the reality is that no deposits are scheduled. Any legitimate payment program would be announced publicly, backed by Congress, and documented on official federal websites. Until that happens, protect your finances, ignore fake alerts, and focus on managing your money through verified credits, refunds, and benefits you actually qualify for.

| What We Know | What’s Still Uncertain | Facts & Data |

|---|---|---|

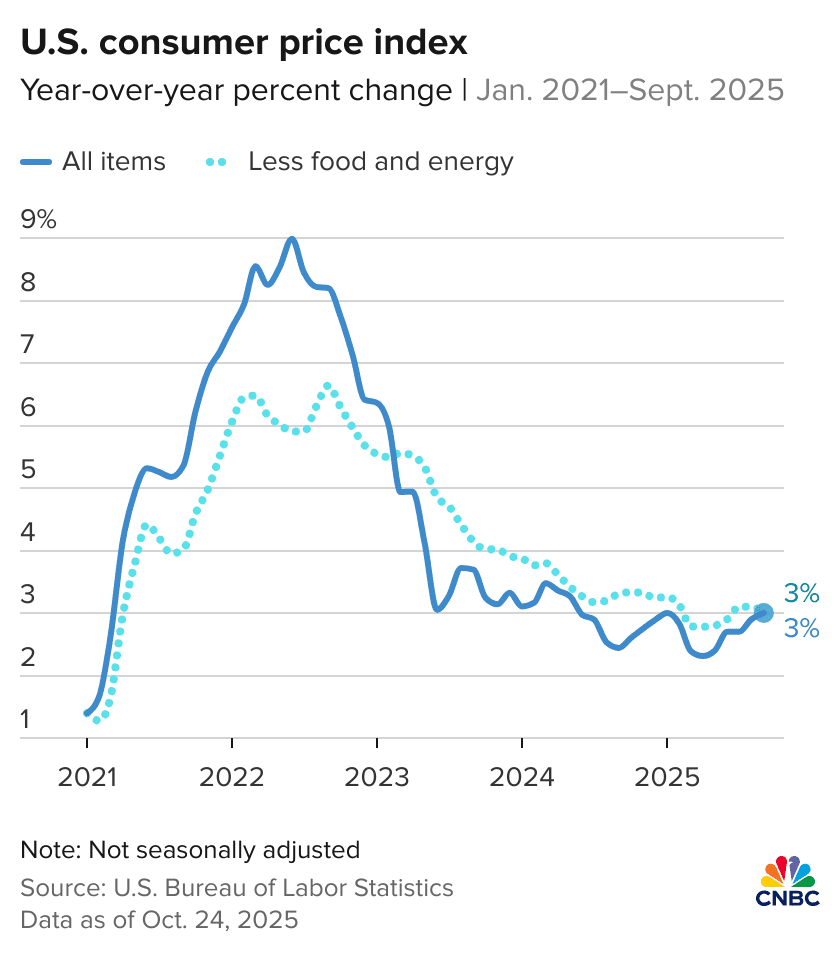

| The proposed $2,000 “federal deposit” stems from Donald Trump’s idea of a tariff dividend, not an existing government program. | Eligibility criteria such as income limits, family size, or filing status have not been determined. | U.S. inflation stands at 3.4% (November 2025), affecting daily expenses. |

| The IRS has not announced any $2,000 payment for December 2025. | There’s no set date for deposits or check distribution. | Federal deficit projected near $1.8 trillion in 2025, limiting fiscal room. |

| No bill or official funding measure has passed Congress. | It’s unclear whether payments would go to individuals, families, or dependents. | The last federal stimulus was through the American Rescue Plan Act (2021). (IRS.gov) |

What Is the Federal $2,000 Deposit Proposal?

The so-called Federal $2,000 Deposit isn’t an official relief payment. It’s based on a political idea nicknamed the “tariff dividend”, proposed by Donald Trump and discussed by a few policy supporters. The proposal suggests using revenue collected from import tariffs — essentially taxes on goods entering the U.S. — to fund direct payments to American households.

It’s designed to sound like a modern version of a “stimulus check.” The idea is that money collected from tariffs on imported products like cars, electronics, and steel could be redistributed to citizens, giving each eligible person around $2,000.

However, here’s the truth: there’s no law authorizing such payments, no IRS plan to distribute them, and no timeline for rollout. It’s purely a political concept, not a government-approved program.

Why People Believe the Federal $2,000 Deposit Arriving Is Real?

1. The Memory of Pandemic Stimulus Checks

From 2020 to 2021, Americans received three rounds of Economic Impact Payments — $1,200, $600, and $1,400. Those checks helped millions of families during COVID-19, with the IRS sending money automatically through direct deposit and paper checks.

That successful rollout created an expectation: when times get tight, Washington might step in again. With inflation still above normal, rising living costs, and election-year talk, people are ready to believe a new round of relief is coming.

2. The “Tariff Dividend” Makes the Pitch Sound Legit

The phrase “tariff dividend” feels official — it implies the government already has the funds and simply needs to distribute them. In reality, tariff revenues go into the general federal budget and are already used to cover spending. Analysts from the Brookings Institution and Congressional Budget Office (CBO) confirm that tariffs alone couldn’t generate enough revenue to fund universal $2,000 checks.

3. Misinformation on Social Media

On platforms like TikTok, X (formerly Twitter), and Facebook, users share screenshots showing “IRS Deposit: $2,000 – Pending.” Many of these are edited images or screenshots from older tax refunds that are being re-circulated. Some scammers also send fake “IRS claim links” asking users to enter their Social Security number or bank details.

The truth? The IRS doesn’t text, email, or message people about payments. All official notices come by mail or through your account.

What’s Actually Happening in December 2025?

As of early December 2025:

- The IRS is not issuing any new stimulus payments or “federal deposits.”

- The only legitimate payments being processed now are regular tax refunds, earned income credits, and Social Security or VA benefits.

- The U.S. Treasury has not announced any emergency relief program or new distribution schedule.

So, if you haven’t seen it there — it doesn’t exist.

Economic Background: Why the Idea Appeals to Many

Let’s be real — life in 2025 isn’t cheap. Gas prices hover near $3.80 a gallon, grocery costs are up nearly 20% from pre-pandemic levels, and housing remains tight in major cities. The average American household now carries over $10,000 in credit-card debt with average interest rates above 24%.

That kind of financial pressure explains why a potential $2,000 check excites people. It’s not greed — it’s survival. Families are stretching paychecks further, and retirees on fixed incomes are struggling to keep pace with cost-of-living increases.

But according to economists, unless Congress passes an official fiscal relief act, no new “stimulus” can happen. The federal government cannot legally send mass payments without explicit authorization and funding.

What Would Need to Happen for $2,000 Checks to Be Real?

Let’s walk through the steps — because understanding the process clears up the confusion.

Step 1: Congress Must Approve a Law

A proposal — like the tariff dividend — must first become a bill and pass both the House and Senate. The President then signs it into law. Without that step, the Treasury has no authority to issue payments.

Step 2: Funding Must Be Secured

Even if approved, the government must identify where the $2,000 per person comes from. With around 170 million eligible taxpayers, that’s $340 billion — more than most entire federal departments’ budgets.

Step 3: The IRS Prepares Payment Systems

The IRS would need to verify records, confirm bank information, issue notices, and prepare direct deposits and paper checks. That takes months — not weeks.

Step 4: The Treasury Announces the Program

Once finalized, official press releases and public bulletins appear on IRS.gov, Treasury.gov, and whitehouse.gov — never through unofficial websites or random social accounts.

Until all those steps happen, the “December 2025 deposit” remains a rumor, not reality.

How to Protect Yourself from Stimulus Scams?

Scammers are quick to jump on trending topics. Here’s how to stay safe:

- Never click links in unsolicited texts or emails claiming you can “claim your $2,000 now.”

- Check web addresses carefully. Real government websites end in

.gov, not.comor.org. - Don’t share personal info. The IRS will never ask for your Social Security number, bank account, or debit card details by phone or message.

- Report suspicious messages to the IRS phishing center at phishing@irs.gov.

Practical Advice: What You Can Do Instead

Even if no federal deposit is on the way, there are smart moves you can make right now:

- Check your tax credits. Many Americans qualify for the Earned Income Tax Credit (EITC) or Child Tax Credit, worth thousands annually.

- Claim unfiled refunds. If you missed filing for 2021, 2022, or 2023, you may still have unclaimed refunds or credits.

- Build a micro-emergency fund. Start with just $20 a week; that’s over $1,000 a year for unexpected costs.

- Use official free filing options. IRS Free File lets you file taxes with no cost if your income is below $79,000.

- Track your real deposits. Use your IRS “Get My Payment” or bank app to verify legitimate deposits instead of relying on screenshots or rumors.

Small, consistent financial actions will protect you far better than waiting for a mythical $2,000 check.

Expert Analysis

Economists and policy analysts have weighed in heavily on the “tariff dividend” idea.

“It’s a politically catchy phrase but economically unrealistic. Tariff revenues fluctuate and can’t fund permanent or large-scale payments,”

says Dr. Erica Sandoval, economics professor at Georgetown University.

“Americans remember how direct payments helped during the pandemic, but this proposal lacks a fiscal foundation,”

adds Ben Ho, senior analyst at the Brookings Institution.

In short, the consensus among experts and bipartisan budget analysts is clear: there is no authorized program, and any such payments would require congressional debate, appropriations, and at least a year of implementation.

Missouri’s 2026 Minimum Wage Increase Explained—Who Benefits and by How Much?

Texas SNAP Payments Set for December 8–14 — Check Payment Dates and Eligibility Criteria

VA Cremation Payouts Revealed: How Much Can Your Family Really Get?