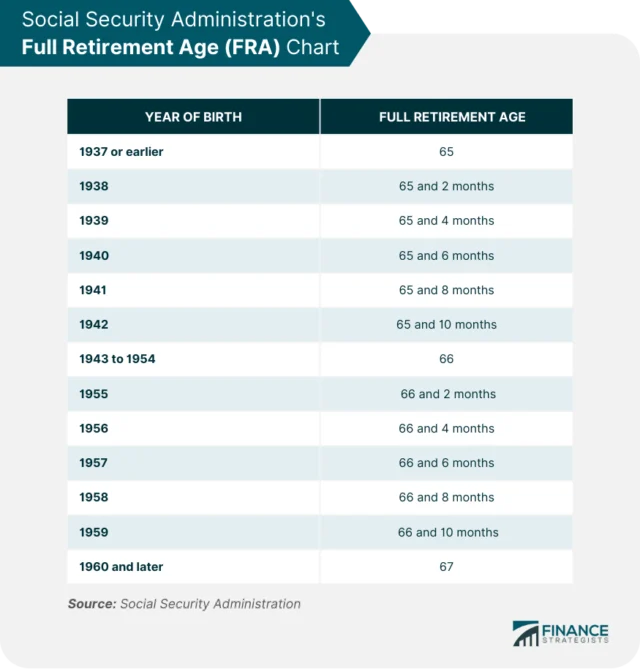

Social Security’s New Age Requirement: Let’s get one thing straight: “Goodbye Retirement at 67” isn’t just a dramatic headline — it’s a real shift in how Americans plan for retirement. With the full retirement age (FRA) for Social Security now officially at 67 for anyone born in 1960 or later, the retirement landscape in the United States has changed — possibly for good. For generations, 65 was the golden number — the age we all associated with slowing down, collecting benefits, and enjoying the rest of our lives. But now, thanks to changing laws, longer lifespans, and economic pressure on Social Security, that picture is evolving. This article unpacks everything you need to know: why this change matters, who it affects, and how to plan your future with clarity and confidence.

Social Security’s New Age Requirement

Goodbye Retirement at 67 signals a new era in American retirement planning. The classic age of 65 is now more of a myth than a milestone. With the full retirement age now officially 67 — and possibly headed higher — Americans need to be smarter, savvier, and more strategic than ever before. Don’t panic — plan. Don’t wait — act. Start by knowing your numbers, boosting your savings, and keeping tabs on changes to Social Security rules and timelines. The more informed you are, the better your retirement can be — whenever you decide to make it happen.

| Topic | Details |

|---|---|

| Full Retirement Age (FRA) | Now 67 for people born in 1960 or later |

| Early Retirement | Allowed at 62, but benefits reduced permanently by up to 30% |

| Delayed Credits | Waiting until age 70 increases monthly benefit by up to 32% |

| Social Security Funding | Comes from FICA payroll taxes (12.4% combined employer/employee) |

| Generational Impact | Gen X, Millennials, Gen Z face higher ages, lower replacement rates |

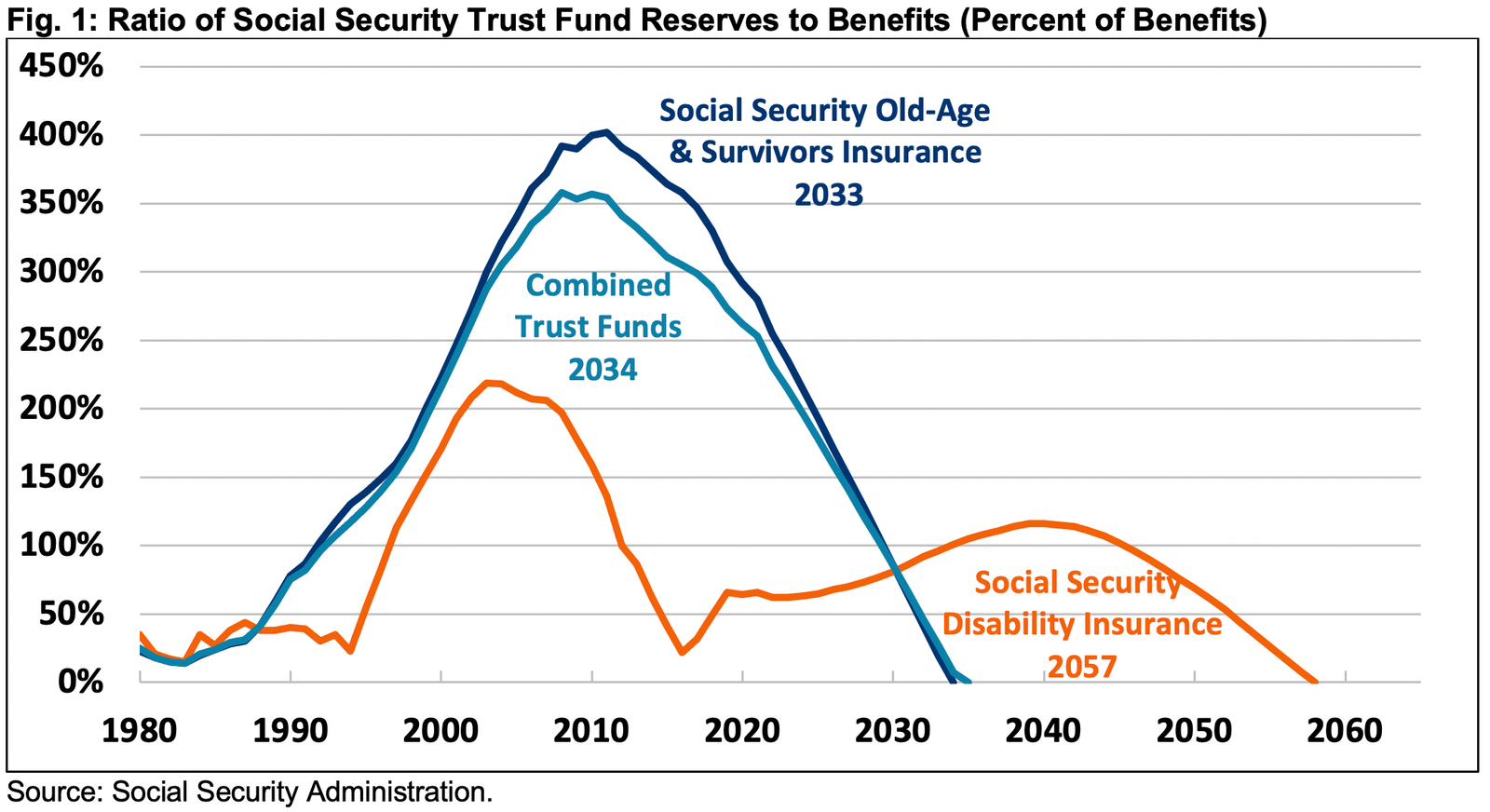

| Solvency Concerns | Trust fund expected to be depleted by 2034, without reforms |

| Official Tools | SSA Retirement Estimator |

What’s Behind the Social Security’s New Age Requirement?

The Social Security Amendments of 1983 laid the groundwork for this shift. Back then, Congress recognized that Americans were living longer and collecting benefits for more years than originally anticipated when Social Security launched in 1935.

To protect the system’s long-term solvency, they decided to gradually raise the retirement age from 65 to 67. The increase was phased in over decades. Now, in 2025, the final group (born in 1960) will reach their official Full Retirement Age of 67.

This change isn’t temporary — it’s structural.

Why Social Security’s New Age Requirement?

Americans Are Living Longer

In 1940, when Social Security first started, life expectancy at age 65 was about 14 years. Today, it’s over 20 years, on average. That’s a big deal for a program designed to support retirees for a “few” years — not decades.

There Are Fewer Workers Supporting More Retirees

Social Security is funded by payroll taxes (FICA). In 1960, there were 5 workers for every 1 retiree. Today, that ratio is closer to 2.8 to 1 — and shrinking. Fewer workers = less money going into the system.

Longer Retirements = Higher Costs

People now retire earlier but live longer. That puts more strain on the program. Raising the retirement age is one way to balance the books without cutting benefit amounts outright.

How Social Security’s New Age Requirement Impacts Different Generations?

Each generation faces unique challenges:

Baby Boomers (1946–1964)

Most are already retired or close to it. Those born before 1960 have a full retirement age between 66 and 66 years, 10 months. Most will not be affected by further changes, unless Congress enacts retroactive benefit reforms.

Gen X (1965–1980)

This generation will be the first to fully face the 67 FRA and may face additional delays if retirement ages increase further. Many Gen Xers have experienced economic volatility (dot-com bubble, 2008 recession), making retirement savings more difficult.

Millennials (1981–1996)

Millennials may see FRA rise to 68 or 70 during their lifetime, especially if further reforms are passed. Many don’t have pensions and rely heavily on 401(k)s and IRAs — but face student debt and high housing costs.

Gen Z (1997–2012)

For this group, Social Security may look completely different. Their FRA could reach 70 or later. Early retirement may become rare unless personal savings or inheritance are significant. They’ll need to start planning as early as possible.

What Is the Financial Difference?

Let’s look at a real example to see the impact of early vs. delayed retirement:

- John, born in 1960, is eligible for $1,800/month at age 67 (full retirement age).

- If he retires at 62, he’ll get only $1,260/month (a 30% reduction).

- If he delays until age 70, his benefit grows to $2,376/month — a 32% boost over FRA.

That’s a $1,116/month swing between retiring at 62 and waiting until 70. Over 20 years of retirement, that’s more than $260,000 in difference.

Timeline: Retirement Age by Birth Year

| Birth Year | Full Retirement Age |

|---|---|

| 1954 or earlier | 66 |

| 1955 | 66 & 2 months |

| 1956 | 66 & 4 months |

| 1957 | 66 & 6 months |

| 1958 | 66 & 8 months |

| 1959 | 66 & 10 months |

| 1960 or later | 67 |

How to Prepare for Retirement in This New Era?

1. Check Your SSA Account

Visit ssa.gov/myaccount and create your free account. You can track your earnings, see your benefit estimates, and calculate your claiming options.

2. Use SSA Retirement Tools

Explore Social Security estimators to model different scenarios — such as retiring at 62, 67, or 70.

3. Save Like You Won’t Get Social Security

Think of Social Security as just one leg of a three-legged stool. The other two are:

- Personal savings (401(k), IRA, Roth IRA)

- Pension (if available)

Experts recommend saving 10–15% of your income for retirement.

4. Watch for Legislation

Keep an eye on congressional proposals to raise the FRA further, change COLA (cost-of-living adjustments), or modify benefits for high earners.

Risks of Relying Only on Social Security

While Social Security is critical, it’s not designed to cover all your needs. The average monthly retirement benefit in 2023 was $1,837.

That’s less than $22,000/year — not enough for most people to live on comfortably.

Additionally:

- Benefits may be taxed depending on your income

- COLAs don’t always keep up with inflation

- The program’s funding shortfall could result in benefit reductions by 2034

So, use Social Security as a base, but plan to supplement it.

First U.S. Guaranteed Income Program; Who’s Eligible and How to Apply Now

Federal $2,000 Deposit Arriving in December 2025 – Complete Guide for All Beneficiaries

Maximize Your SNAP Benefits; Simple Steps to Get More Food Stamps Every Month