Federal $2,000 Deposit Coming: You’ve seen the headlines: “Federal $2,000 Deposit Coming December 2025” — bold claims that sound like a repeat of past stimulus checks. It’s all over social media. Some videos even show screenshots of alleged “pending deposits.” People are asking: Is this true? Where’s my money? How do I get mine? We’re here to give it to you straight: there is currently no federal government program officially sending out a $2,000 deposit to all Americans in December 2025. No law has been passed. No official date confirmed. And no eligibility rules exist — yet. If that changes, the Internal Revenue Service (IRS) will announce it through official channels. So what’s the buzz all about? Let’s dive in.

Federal $2,000 Deposit Coming

To recap, the “Federal $2,000 Deposit Coming December 2025” claim is currently not true in any official capacity. It’s based on a proposed idea, not a passed law. The IRS has not confirmed any payments, no eligibility rules exist, and no payment date has been announced. However, you may still be eligible for real refunds, credits, and benefits under existing IRS programs. Always verify with trusted, high-authority sources — not social media.

| Topic | Details |

|---|---|

| Program Status | Not approved — no law passed for a $2,000 December 2025 stimulus. |

| Source of Rumor | A proposed “tariff dividend” discussed by political figures — not legislation. |

| IRS Confirmation | IRS has made no official statement confirming December 2025 stimulus. |

| Payment Date | None confirmed. The rumored date is speculative. |

| Eligibility | No official IRS eligibility list or application process exists. |

| Trusted Source | Official IRS newsroom: irs.gov/newsroom |

Understanding the Federal $2,000 Deposit Coming Buzz

Let’s rewind. During 2020 and 2021, most Americans received stimulus checks due to the COVID-19 pandemic — those were passed by Congress under laws like the CARES Act and the American Rescue Plan Act. At the time, payments were fast-tracked through the IRS.

But here in 2025, nothing similar has been approved for December.

What’s going on is a mix of political rhetoric, recycled headlines, and social media rumors. The $2,000 amount comes up a lot — but the most notable source is a proposed idea from former President Donald Trump, called the “Tariff Dividend.”

What is the Tariff Dividend Proposal?

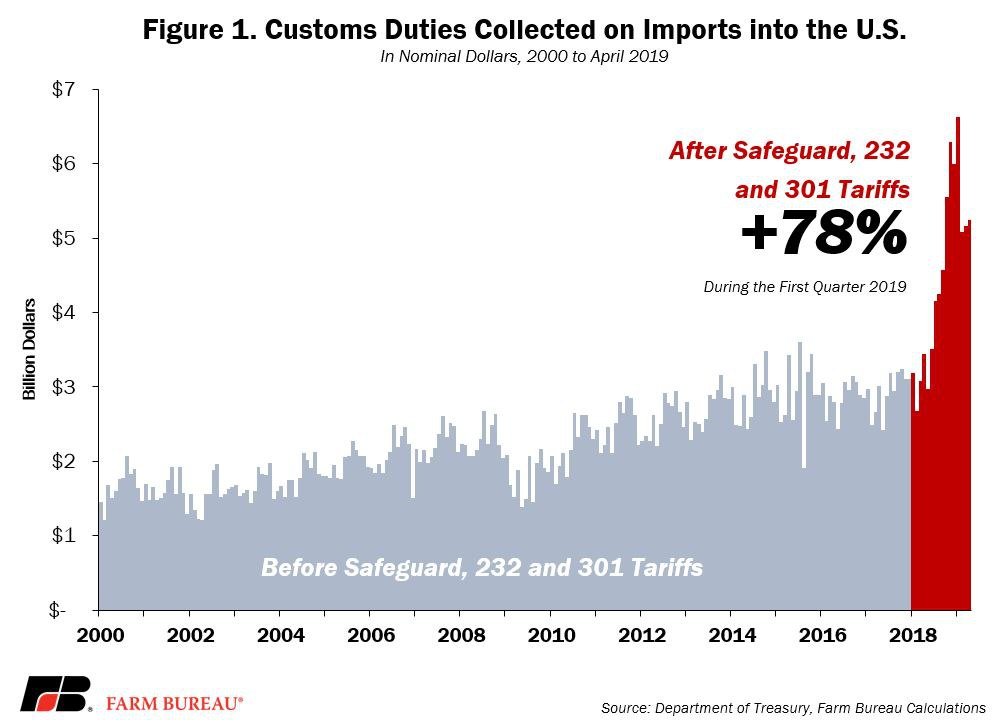

In mid-2025, Trump floated the idea of a $2,000 “tariff dividend” check to American families. The theory? The U.S. collects billions in tariffs (taxes on imported goods) — why not give some of that money directly back to Americans?

Here’s how it was framed:

- U.S. businesses import goods from countries like China.

- Tariffs (import taxes) are collected by the federal government.

- That revenue could be redistributed to citizens in the form of direct checks.

Sounds nice in theory, right?

But here’s the problem:

- Congress has not passed any law to make this happen.

- Tariff revenues are nowhere near enough to cover $2,000 per adult.

- There’s no formal plan or funding mechanism in place.

As of now, this remains a political idea, not a policy.

What Experts and Analysts Are Saying About Federal $2,000 Deposit Coming?

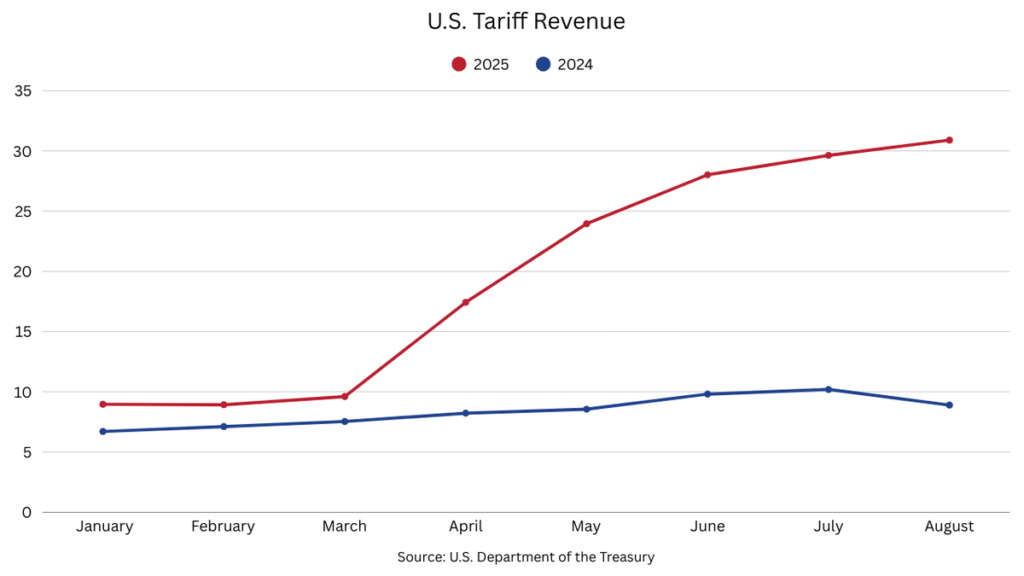

Economists and policy experts have weighed in heavily on the topic. According to the nonpartisan Committee for a Responsible Federal Budget (CRFB), if the government were to send $2,000 checks to every American adult, it would cost nearly $500 billion — far more than the U.S. collects in annual tariff revenue, which totaled just $93.8 billion in FY 2024, per the U.S. Treasury.

Experts argue that:

- Most tariff revenue is already allocated in the federal budget.

- Reallocating it would likely require cutting services or raising taxes elsewhere.

- The “tariff dividend” concept has not been reviewed by the Congressional Budget Office.

So while it’s not impossible, it’s also not realistic under current economic conditions, especially with inflationary concerns and national debt rising.

Real Deposits vs. Rumored Payments: Why the Confusion?

You might be wondering: “But I saw someone post a $2,000 deposit screenshot on Twitter!”

That could be for a number of legitimate reasons — and here are just a few:

- IRS Refunds: Many people are receiving late 2024 or early 2025 tax refunds.

- Amended Returns: Some filers receive corrections to prior years’ returns.

- Tax Credits: Expanded Child Tax Credit or Earned Income Tax Credit (EITC) payments may arrive and be mistaken for stimulus.

- Social Security Back Payments: Disability or SSI back pay may total thousands and appear as lump sums.

But these are not stimulus checks. These are individual payments based on personal tax filings, not a universal $2,000 stimulus from the federal government.

How Federal $2,000 Deposits Are Actually Authorized?

To separate fact from fiction, it helps to understand the real process of government payments.

Step-by-Step Breakdown:

- Legislation Introduced in Congress: A bill proposing payments is submitted.

- Debate and Revision: It goes through both chambers — House and Senate.

- Approval by Vote: If passed, the bill moves to the President for signature.

- Funding Mechanism Assigned: Congress must allocate budget for the payment.

- IRS or Treasury Administers the Program: The IRS decides eligibility, timelines, and distribution methods.

- Public Communication: Updates are shared via IRS.gov and official channels.

None of these steps have been completed for a 2025 stimulus check.

Watch Out for Scams & Clickbait

As with any viral government payment news, scams are everywhere. And December is prime time for fraudsters looking to take advantage of confusion.

How to Spot a Scam:

- Any message claiming “you must click here to receive your $2,000 stimulus.”

- Calls or texts claiming to be from “IRS agents.”

- Fake IRS websites (always check for

.gov). - Requests for your Social Security number, bank login, or debit card PIN.

The IRS will never ask for sensitive info via email, text, or social media.

How Professionals Should Respond to Client Questions?

If you’re a financial advisor, tax preparer, or accountant, your clients may already be asking you:

“Is this $2,000 stimulus real?”

Here’s how to respond with clarity and confidence:

- Stick to official sources. Refer clients to IRS.gov.

- Print or email the IRS newsroom link for updates.

- Educate clients about how tax refunds and stimulus programs differ.

- Encourage cautious optimism. It’s okay to say “maybe someday,” but emphasize there’s nothing real yet.

Being the voice of truth builds long-term trust — especially when others are spreading misinformation.

$5,108 Social Security Payment in December: Check Eligibility Criteria & Full Payment Schedule

VA Cremation Payouts Revealed: How Much Can Your Family Really Get?

First U.S. Guaranteed Income Program; Who’s Eligible and How to Apply Now