Seniors Set to Receive $5,108: Seniors set to receive $5,108 in December 2025 is one of the most searched phrases about Social Security benefits this year. But what exactly does it mean, who qualifies, and how can you understand the rules so you’re not left confused or misled by headlines? This in‑depth guide explains everything — in clear, conversational language, backed by official data and useful examples. Here’s the straight talk: $5,108 is the maximum monthly Social Security benefit someone can receive in 2025 based on laws and benefit formulas. It is not a guaranteed payment for everyone, not an extra “bonus,” and not a new government stimulus. Most retirees receive much less each month. The amount anyone gets is based on their lifetime earnings, age when claiming, and the Social Security formula used by the Social Security Administration (SSA).

This guide will help you understand:

- How Social Security benefits are calculated

- Who may qualify for up to $5,108

- When December 2025 Social Security payments are scheduled

- Work limits, special rules, and common questions

- Practical tips to maximize your benefit

Everything below is explained plainly but also backed by credible sources, such as the official Social Security Administration website.

Seniors Set to Receive $5,108

The headline “Seniors set to receive $5,108 in December 2025” refers to the maximum possible monthly Social Security benefit someone could receive in 2025 with high lifetime earnings and delayed claiming up to age 70. It is not a flat payment for all beneficiaries. Most retirees receive amounts closer to the national average of around $2,009 per month. Social Security payments are made in December 2025 based on birth dates, with December 1 for SSI and December 10, 17, and 24 for regular benefits.

| Topic | Details |

|---|---|

| Maximum Monthly Benefit (2025) | $5,108 (for retirees who delay benefits until age 70 and have high lifetime earnings) |

| Average Monthly Benefit (2025) | Approximately $2,009 for retired workers |

| December 2025 Payment Dates | SSI: December 1; Standard Social Security: December 10, 17, 24 |

| 2026 Cost‑of‑Living Adjustment (COLA) | Estimated +2.8% starting January 2026 |

| Work and Earnings Limits (2025) | $23,400 if under full retirement age |

| Official Resource for Benefit Details | Social Security payment dates and rules: https://www.ssa.gov |

Understanding the Seniors Set to Receive $5,108 Figure

When you see “Seniors set to receive $5,108 in December 2025,” that number refers to the maximum possible monthly Social Security retirement benefit under current rules for 2025. This does not mean every retiree will get that amount. It’s a ceiling — the highest monthly amount someone with a very specific earnings and claiming history could receive.

The Social Security Administration (SSA) calculates retirement benefits based on:

- Your 35 highest years of earnings,

- Adjustment for inflation,

- Your age when you choose to start benefits.

If someone delays claiming their Social Security benefits beyond Full Retirement Age (FRA) — up to age 70 — they earn delayed retirement credits, which can significantly boost monthly payments. This is how some people can reach the maximum benefit amount.

The true maximum benefit amount changes over time based on wage growth, inflation indexing, and Social Security rules. The $5,108 figure for 2025 comes from SSA benefit formulas and maximum taxable earnings in the years used to compute benefits.

How Social Security Benefits Are Calculated?

To understand what you might receive each month, you should understand the basic calculation steps the SSA uses.

Step 1: Work and Earnings History

SSA looks at your 35 highest‑earning years. If you worked fewer than 35 years, zeros are added for the missing years. This lowers your benefit.

Step 2: Average Indexed Monthly Earnings (AIME)

Your earnings in each of those 35 years are adjusted for inflation and then averaged. This gives your AIME.

Step 3: Primary Insurance Amount (PIA)

SSA applies a formula to your AIME to determine your Primary Insurance Amount (PIA). This is essentially your benefit at your Full Retirement Age (FRA).

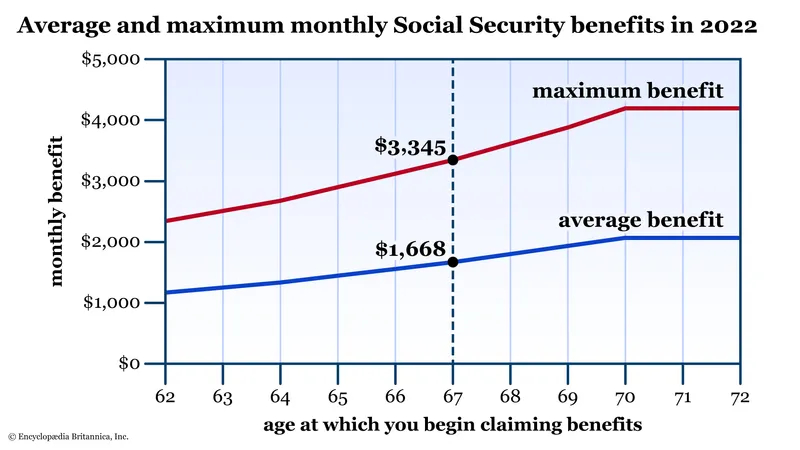

Step 4: Age at Claiming

If you claim before your Full Retirement Age (as early as age 62), SSA reduces your monthly benefit. If you delay claiming after FRA up to age 70, SSA increases your monthly benefit with delayed retirement credits.

These formulas and rules are official and published by the Social Security Administration. For the most accurate, personalized estimate, you can log into your My Social Security account at: https://www.ssa.gov/myaccount/

What Is Full Retirement Age (FRA)?

Your Full Retirement Age (FRA) depends on your birth year and is the age at which you qualify for your full, unreduced retirement benefit.

For most people retiring in 2025:

- FRA is 66 and some months, or 67 depending on your birth year.

If you claim benefits before FRA:

- SSA reduces your benefit permanently.

If you claim benefits after FRA, up to age 70:

- SSA increases your benefit.

- This is how someone could reach the $5,108 maximum.

December 2025 Social Security Payment Schedule

Social Security distributes retirement and disability benefits on a monthly basis. The payment date is tied to your birth date if your benefits started after May 1997.

Here’s the schedule for December 2025:

Standard Social Security Retirement & Disability Payments

| Birth Date | Deposit Date |

|---|---|

| 1st – 10th | December 10, 2025 |

| 11th – 20th | December 17, 2025 |

| 21st – 31st | December 24, 2025 |

Supplemental Security Income (SSI)

SSI benefits are typically paid on the 1st of each month or the first business day. For December 2025, SSI eligible recipients often receive payment on December 1, 2025. Because New Year’s Day falls on a holiday weekend, January 2026 SSI payments may arrive early (e.g., on December 31, 2025).

SSI is a different program from regular Social Security retirement benefits — it is needs‑based and federally funded rather than based strictly on payroll tax contributions.

Average Benefit vs. Maximum Benefit

Most Americans receive a monthly Social Security benefit far below $5,108.

According to financial publications and SSA projections, in 2025:

- The average monthly Social Security benefit for retired workers is around $2,009.

- Many beneficiaries depend on these payments to cover essential expenses, such as rent, utilities, food, and healthcare.

This contrast between the headline maximum and the average benefit is one reason many people are confused by the “$5,108” figure.

Can You Work and Still Receive Benefits?

Yes, but if you are below Full Retirement Age, your earnings can affect your benefit amount.

For 2025:

- If you’re under full retirement age the entire year and earn more than $23,400, SSA will deduct $1 from your benefits for every $2 you earn above that limit.

- In the year you reach full retirement age, a different higher earnings limit applies, and fewer deductions occur.

- Once you reach full retirement age, you can work without any reduction in your Social Security benefits due to earnings.

Seniors Set to Receive $5,108: Special Circumstances You Should Know

1. Survivor Benefits

Survivor benefits are available to spouses, children, and dependent family members of deceased workers who qualified for Social Security. These benefits are calculated differently than standard retirement benefits.

2. Disability Benefits (SSDI)

Social Security Disability Insurance (SSDI) supports people who become disabled and cannot work. SSDI benefits are not the same as retirement benefits, but they are administered by the same agency.

3. Spousal and Family Benefits

Spouses and dependents may qualify for benefits based on the earnings record of a covered worker. This includes spousal benefits, which can be up to 50% of the worker’s PIA at full retirement age.

Cost‑of‑Living Adjustment (COLA) for 2026

Each year, Social Security benefits may increase with a Cost‑of‑Living Adjustment (COLA) to help benefits keep pace with inflation.

For 2026, the SSA has announced an estimated COLA increase of about 2.8%, which will be reflected in payments starting in January 2026. COLA adjustments help ensure that benefits maintain purchasing power as prices rise.

First U.S. Guaranteed Income Program; Who’s Eligible and How to Apply Now

Federal $2,000 Deposit Arriving in December 2025 – Complete Guide for All Beneficiaries

Goodbye Retirement at 67: Social Security’s New Age Requirement Is Reshaping America’s Future

Practical Advice for Retirement Planning

- Delay claiming benefits when possible if you are in good health and don’t need the cash early — delayed retirement credits can substantially increase your monthly benefit.

- Open a My Social Security account and review your earnings history to make sure it’s correct.

- Plan for taxes and healthcare costs in retirement — Social Security is often just one part of total retirement income.

- Consult a financial advisor to integrate Social Security strategy with your overall retirement plan.