U.S. Government Confirms $1,500 Bank Deposits: If you’ve been online lately, you’ve probably seen headlines like: “U.S. Government is depositing $1,500 into bank accounts — see if you qualify!” Sounds exciting, right? Who wouldn’t want a surprise deposit like that? But let’s pause, breathe, and get the facts straight. There is no new or universal $1,500 federal government payment being deposited into everyone’s bank account. However, there are real financial deposits happening for certain people. These are based on things like unclaimed tax credits, state-level tax relief programs, or past IRS adjustments. So yes — some people may be getting a check or deposit around $1,400–$1,500, but it’s not a new stimulus check for all. In this article, we’ll walk through everything you need to know — clearly, honestly, and with practical steps you can take.

U.S. Government Confirms $1,500 Bank Deposits

- No, there’s no $1,500 surprise deposit coming to all Americans.

- Yes, some people are getting deposits of $1,400–$1,500, but those are tied to specific tax credits, refunds, or state programs.

- The best way to know if you qualify is to use the IRS tools or contact your state tax office.

- Stay safe — avoid scams, ignore spammy links, and always double-check the source.

Whether you’re a taxpayer, a financial professional, or just someone who wants clarity — facts beat hype every time.

| Fact / Topic | Quick Explanation |

|---|---|

| No universal $1,500 federal payment | No new stimulus in 2025 |

| Recovery Rebate Credit payments | IRS is sending unclaimed credits from prior tax years |

| State programs may pay $1,000–$1,500 | Programs like New York STAR or property tax rebates |

| IRS tools can confirm your payment status | Use “Where’s My Refund” and “Get My Payment” |

| Beware of scams and phishing messages | Fraudsters use IRS and deposit claims as bait |

Where Did U.S. Government Confirms $1,500 Bank Deposits Claim Come From?

Let’s be clear: the U.S. government has not authorized a blanket $1,500 payout for 2025. But people are seeing that number because of these key factors:

- IRS Recovery Payments – Some taxpayers are still receiving up to $1,400 from the 2021 Recovery Rebate Credit, part of the third stimulus round.

- State-level Programs – States like New York have programs that issue payments of up to $1,500 for things like property tax relief.

- Refund Corrections – In 2024 and 2025, the IRS has proactively corrected some tax filings, leading to unexpected deposits.

- Misinformation – Social media and clickbait articles often misinterpret these real payments and imply that everyone is eligible — which is false.

The bottom line? Some people are getting paid — but not everyone.

What is the Recovery Rebate Credit?

Back in 2021, under the American Rescue Plan, eligible individuals were entitled to $1,400 stimulus payments. But if someone didn’t receive the full amount — maybe they had a new child, or didn’t file taxes that year — they could claim it later as a Recovery Rebate Credit.

According to a recent IRS press release in October 2024, more than 1 million taxpayers did not claim this credit and are now being issued payments automatically after a review.

So yes, if you’re seeing deposits around $1,400, they’re real, but they are late payments for old tax credits — not a new handout.

State Payments and Local Programs: Up to $1,500

Beyond federal programs, states have their own relief initiatives.

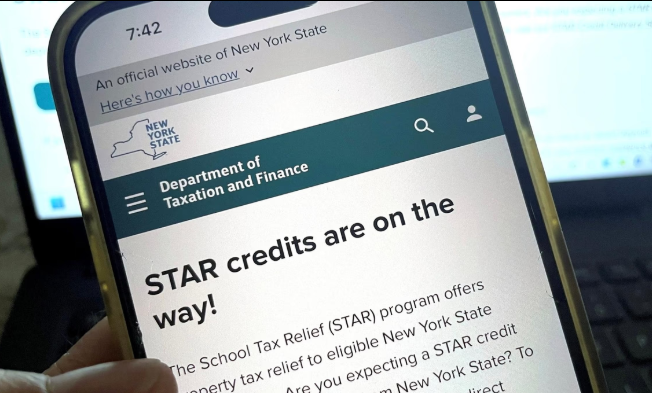

New York’s STAR Program

For example, New York’s STAR (School Tax Relief) gives homeowners and seniors school property tax credits. These can range from a few hundred dollars to over $1,500, depending on eligibility and location.

- Basic STAR is available for primary residences with income under $250,000.

- Enhanced STAR is for seniors 65+ with income under $98,700 (as of 2024).

These credits can come via checks or direct deposits — which can look like surprise money if you didn’t track the program closely.

Other states with similar programs include:

- California — Middle-Class Tax Refunds

- Colorado — TABOR refunds

- New Mexico — Tax rebates for low-income residents

Check your state’s department of revenue or taxation website for eligibility and payout schedules.

How to Check If You’re Eligible for $1,500 Bank Deposits?

You don’t need to guess. You can check right now if a deposit is coming your way.

1. Use IRS.gov Tools

Go to www.irs.gov

- Where’s My Refund? – Track current year refund status.

- Get My Payment – See if a stimulus or credit was issued.

- View Your Account – Look at your balance, payments, or notices.

- Get Transcript – See past tax data and amendments.

You’ll need your:

- SSN or ITIN

- Filing status (e.g. single, head of household)

- Refund amount (if applicable)

If you’re owed something, the IRS will list it — and that’s the only source you should trust.

2. Review Old Tax Returns

Check if you:

- Missed claiming the Recovery Rebate Credit in 2021.

- Forgot dependents that would qualify you for higher credit.

- Did not file at all during eligible years.

You can file or amend past returns using IRS Form 1040-X.

3. Contact Your State Tax Office

Go to your state’s official tax website and search:

- “property tax relief”

- “rebate”

- “credit”

- “senior programs”

Avoid third-party blogs or sketchy links — stay on .gov domains only.

$1,500 Bank Deposits Scam Alerts — What to Watch For

Whenever people hear about “free money,” scammers show up fast. Don’t get caught.

Common Scams

- Fake IRS texts saying “Claim your $1,500 check here.”

- Phishing emails pretending to be from the Department of Treasury.

- Bogus websites that collect personal info to “verify eligibility.”

These are NOT from the IRS or any government body.

The IRS does NOT:

- Call you about stimulus checks.

- Text or email you links to claim payments.

- Ask for your bank login or SSN via message.

When in doubt, don’t click — go directly to irs.gov or your bank’s website.

Real-Life Examples of $1,500 Bank Deposits

Case 1: Unclaimed Stimulus

In 2024, Maria, a single mom in Texas, filed her 2021 return late. She hadn’t claimed the Recovery Rebate Credit. The IRS issued a $1,400 payment in May 2025 after reviewing her return.

Case 2: State Tax Relief

Tom, a retired homeowner in upstate New York, automatically received a $1,500 STAR credit in September 2025. It showed up as a direct deposit from “NY Dept of Tax.”

Neither of them applied for a “$1,500 surprise deposit” — but they qualified for legitimate programs.

Federal $2,000 Deposit Coming December 2025; Are You Eligible? Exact Payment Date

VA Cremation Payouts Revealed: How Much Can Your Family Really Get?

Missouri’s 2026 Minimum Wage Increase Explained—Who Benefits and by How Much?