Federal $2,000 Deposit: “Federal $2,000 Deposit Expected in December 2025” — if you’ve seen that headline floating around social media, news blogs, or even group chats, you’re not alone. Millions of Americans are wondering, “Is the government really about to drop a $2,000 check into my account this month?” The short answer? Not so fast. There’s a lot more to this story, and we’re about to break it down for you, in plain English, no fine print, no hype. This article gives you the real deal: What’s happening, who might get paid, who definitely won’t, and what to watch for next. So whether you’re a retiree in Oklahoma, a single mom in New York, or a tax professional in California — read on for everything you need to know about the rumored $2,000 federal deposit.

Federal $2,000 Deposit

Let’s keep it simple and honest: There is currently no $2,000 federal deposit scheduled for December 2025. While political figures have floated ideas like the “tariff dividend,” no law has passed, and the IRS has not issued any payment guidance. But that doesn’t mean you should ignore the topic — especially with elections and economic shifts ahead. Stay informed, avoid scams, and make sure your tax and banking records are in order. That way, if and when Congress does act, you’re ready to receive anything you’re entitled to — no drama, no delay.

| Topic | Current Status |

|---|---|

| $2,000 Payment | Not approved or official |

| Funding Mechanism | Proposed “Tariff Dividend” |

| Eligibility | Speculative, based on past models |

| Payment Timeline | No schedule confirmed |

| Scam Risk | High — fake sites & texts circulating |

| How to Prepare | File taxes, update IRS info |

What’s Driving the Buzz About a Federal $2,000 Deposit?

The idea of a $2,000 deposit from the federal government this December gained traction due to a mix of online rumors, political commentary, and recent economic proposals. Some websites — often designed to attract clicks — used eye-catching headlines like:

- “$2,000 Coming to All Social Security Recipients”

- “IRS Approves $2,000 Check for December”

- “Trump’s $2,000 Tariff Dividend to Hit Accounts Before Christmas”

Here’s the hard truth: No law has been passed to authorize a $2,000 payment for December 2025. The IRS has not released any official notice confirming direct deposits of this kind. These stories are built on speculative interpretations of political proposals, especially one concept called the “tariff dividend”.

The Tariff Dividend Proposal — Real or Just Talk?

Former President Donald Trump and several allies have pushed for a new kind of financial relief program they call a tariff dividend. The idea is that revenue collected from tariffs — taxes placed on goods imported from foreign countries — could be redistributed to American citizens in the form of direct payments.

Here’s what this proposal involves:

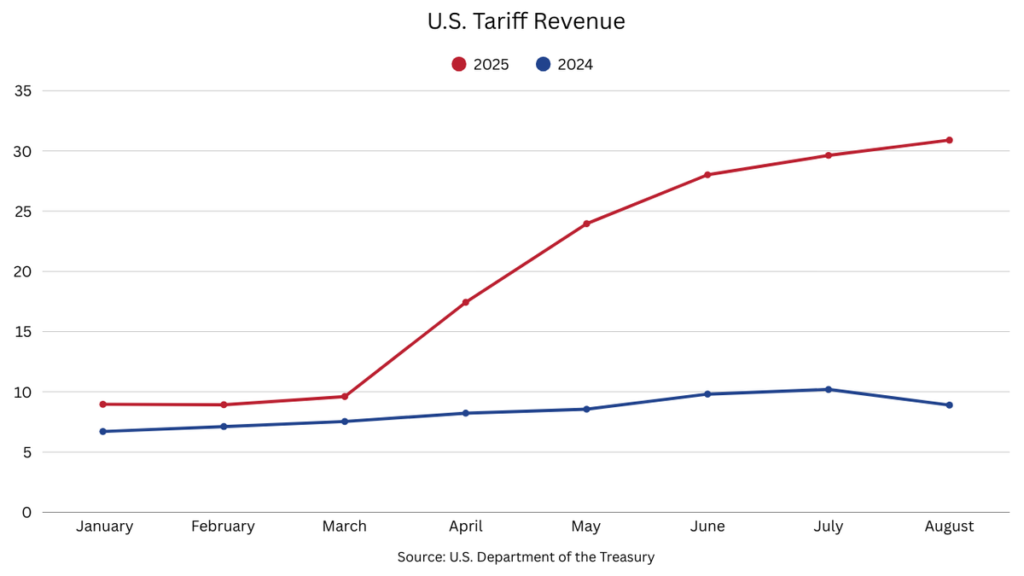

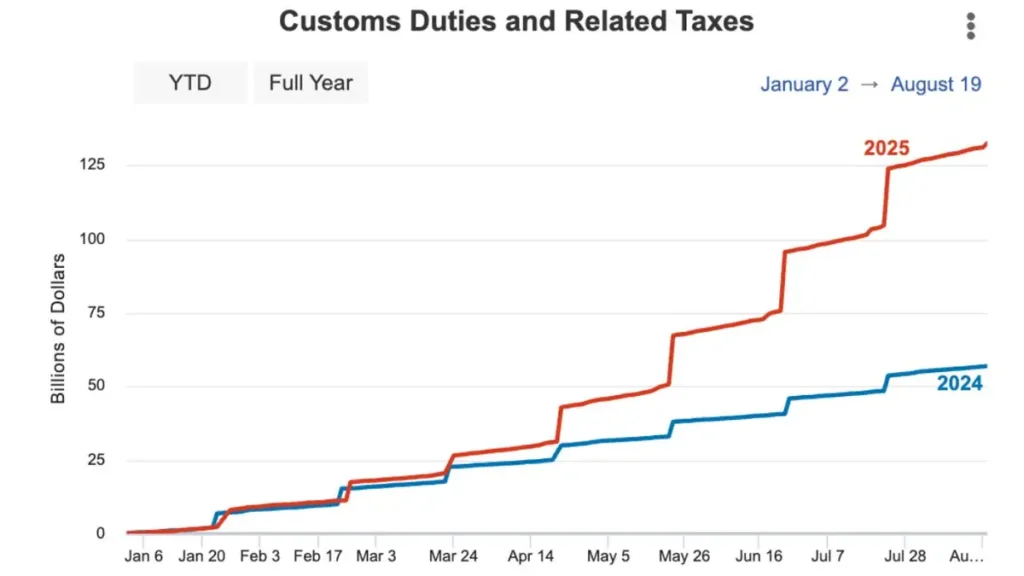

- The U.S. collects billions in tariffs annually, especially from countries like China.

- Advocates argue this money could be sent to U.S. citizens — potentially around $2,000 per person — as a type of “rebate” or dividend.

- The program would bypass traditional welfare systems and deliver money directly, similar to past stimulus checks.

But here’s the kicker: this proposal is not law. It has not passed Congress. It’s not part of the 2025 budget. And while it may be a talking point for the 2026 election cycle, no official federal program exists to distribute this money — at least not yet.

For reference, tariff revenue in FY 2023 totaled around $80–90 billion. A $2,000 check to every eligible American would cost upwards of $400 billion, creating a huge gap. Economists at the Tax Foundation have raised concerns that such a policy might require borrowing, increase inflation, or involve cuts elsewhere.

Why People Believe the Federal $2,000 Deposit Real?

There’s good reason people are confused — and hopeful:

1. Memory of Pandemic Stimulus Checks

Most Americans vividly remember the federal stimulus payments during the COVID-19 pandemic:

- $1,200 in Spring 2020

- $600 in early 2021

- $1,400 in March 2021

These were real, fast, and helpful. For many families, those checks were the difference between making rent or falling behind. That memory fuels belief that another round is possible.

2. Hardship Is Still Real

Inflation has cooled slightly, but groceries, rent, and utilities remain stubbornly high. Economic recovery hasn’t hit everyone evenly. For many households living paycheck-to-paycheck, a $2,000 check would be a game changer.

3. Clickbait and Misinformation

Some outlets — including TikTok influencers and low-credibility blogs — combine real facts with unverified claims, giving the impression that a program exists. When combined with a political quote or budget excerpt, it can feel official even when it’s not.

What Would Have to Happen for the Federal $2,000 Deposit to Be Real?

Let’s spell this out step-by-step — because nothing like this happens overnight.

Step 1: A Bill Must Be Proposed and Passed by Congress

This would require votes in both the House of Representatives and the Senate. Lawmakers would need to agree on:

- Funding source

- Eligibility requirements

- Distribution method

- Oversight and fraud prevention

Step 2: The President Must Sign It Into Law

Whether it’s President Biden or a future administration, no check goes out until the bill is signed into law.

Step 3: The IRS and Treasury Must Implement It

This part takes time. Even when the 2021 stimulus check passed, it took 2–3 weeks minimum for direct deposits to roll out. Paper checks took even longer.

So if the law were passed today, it would likely be January or February 2026 before you’d see any money.

Who Would Be Eligible — If It Happens?

While no official eligibility has been published, past federal relief programs offer insight into what eligibility might look like.

Here’s a breakdown:

Most Likely Eligible:

- Social Security recipients

- Disability (SSI/SSDI) recipients

- Veterans receiving VA benefits

- Low-to-middle income earners (under $75,000 single / $150,000 married)

- Parents or caregivers with dependents

Probably Not Eligible:

- Non-resident aliens

- High-income households (based on phase-out limits)

- Those who didn’t file taxes or can’t be verified through IRS/SSA records

Note: In prior stimulus rounds, individuals without banking info on file with the IRS often received paper checks or prepaid debit cards by mail.

Could This Be Confused With Other Payments?

Yes, and that’s another reason for the confusion. Some Americans may see deposits from programs like:

- Social Security Cost of Living Adjustments (COLA) — up to 3.2% in 2025

- Earned Income Tax Credit (EITC) or Child Tax Credit (CTC) refunds

- State-level rebates or energy assistance

These can total around $1,000–$2,000 in some households, especially during tax refund season — but they’re not a universal federal $2,000 deposit.

Real Ways to Prepare (Just in Case)

Even though there’s no confirmed program, it doesn’t hurt to be ready:

- File your 2024 taxes on time

This keeps you on the IRS radar and helps determine eligibility. - Ensure your bank info is correct

Use the IRS “Get My Payment” tool when available to update direct deposit details. - Sign up for IRS online account access

It allows you to monitor your account, refund status, and any notices.

Scam Alert: Don’t Fall for These

Where money rumors go, scammers follow. The Federal Trade Commission (FTC) has already issued warnings about scam messages claiming to “unlock” a $2,000 check.

What Scammers May Do:

- Send fake IRS emails with malicious links

- Ask for “processing fees” to access the payment

- Request your Social Security number or bank account

- Claim to work for the “Relief Disbursement Department” (which doesn’t exist)

What You Should Do:

- Never click unknown links or give out personal data

- Report scam texts/emails to ReportFraud.ftc.gov

Federal $2,000 Deposit Arriving in December 2025 – Complete Guide for All Beneficiaries

IRS Sets December 18 Start Date for New $2000 Direct Deposit Payments

Department of Education Adds Earnings Indicator to FAFSA; How It Could Affect Your Financial Aid