IRS Approves $2,000 Direct Deposit: “IRS Approves $2,000 Direct Deposit for December 2025.” You’ve probably seen this headline on TikTok, Instagram, Facebook, or some blog with an urgent-sounding title. It sounds official. It sounds like a surprise holiday blessing. And it sounds like you should already be checking your bank account. But is it real? Here’s the truth: There is currently no official IRS-approved $2,000 stimulus check scheduled for December 2025. While some folks may receive deposits of around $2,000 this month, those are not part of a new federal stimulus program. Let’s dive into the facts — plain and simple.

IRS Approves $2,000 Direct Deposit

To wrap it up: there is no official IRS-authorized $2,000 stimulus payment happening in December 2025. What’s really going on is a mix of year-end tax refunds, state rebates, political proposals, and wishful thinking. If you’re seeing a deposit, it’s probably a refund from taxes or credits you already qualified for. And remember — if something sounds too good to be true, double-check it first.

| Topic | Status |

|---|---|

| Official $2,000 IRS stimulus check | Not approved |

| Tariff dividend proposal by politicians | Proposed, not passed |

| Refunds from 2024 tax returns or credits | Real |

| State-level relief payments | Possible, varies by state |

| IRS confirms routine year-end payments | Ongoing |

The Truth About the IRS Approves $2,000 Direct Deposit for December 2025

First things first: the IRS has not issued any official statement confirming a $2,000 payment to all taxpayers in December 2025.

This rumor likely stemmed from:

- Misinterpretations of tax refunds

- Speculation about tariff dividend proposals

- Social media hype with clickbait headlines

In reality, many Americans will see deposits from the IRS this month, but they’re tied to refunds, existing tax credits, and state programs — not a new federal check.

How Did We Get Here? Why Everyone’s Talking About This

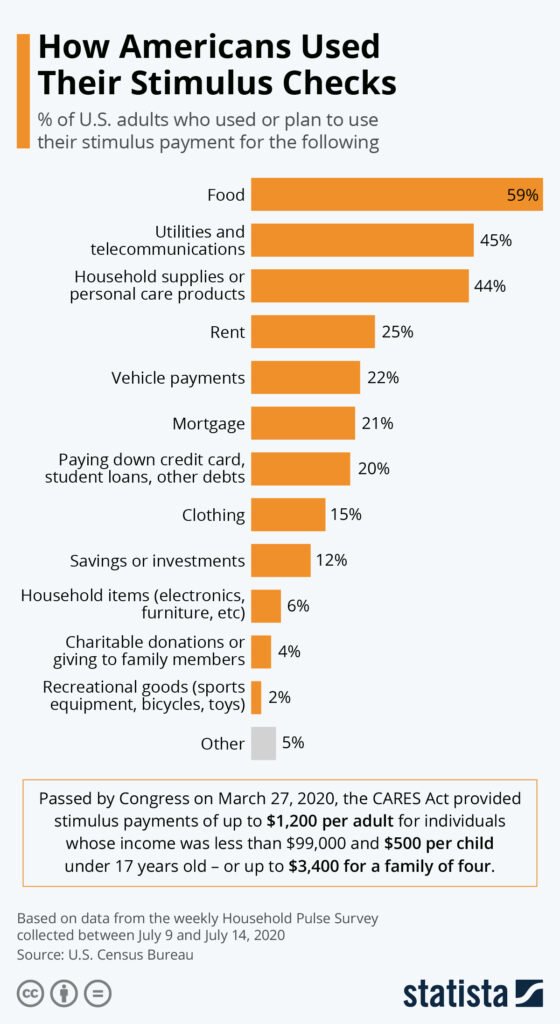

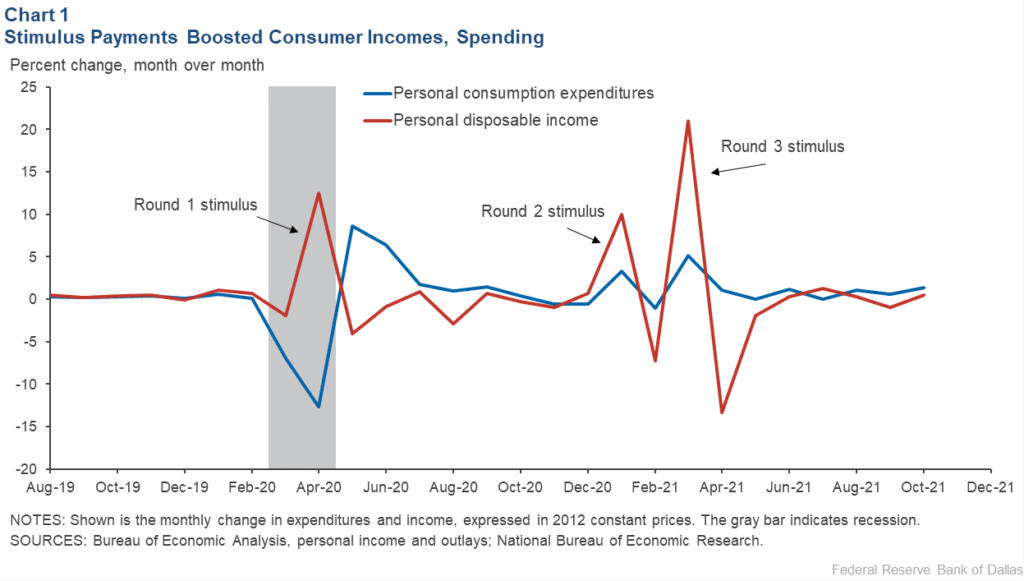

1. Memories of COVID-Era Stimulus Checks

During 2020 and 2021, Americans received up to three rounds of federal stimulus payments, also called Economic Impact Payments (EIPs):

- Round 1: $1,200 (March 2020)

- Round 2: $600 (December 2020)

- Round 3: $1,400 (March 2021)

Those checks were based on income thresholds and were automatic for most taxpayers.

It’s no surprise that people today — facing inflation, rising rents, and holiday spending pressure — are hoping another check will drop soon. Unfortunately, as of December 2025, no such stimulus has been signed into law.

2. The “Tariff Dividend” Proposal

Former President Trump and some political figures have suggested a “tariff dividend” — a $2,000 check funded by tariffs on foreign goods.

Here’s the catch: this is just a proposal.

Congress hasn’t voted on it. The President hasn’t signed it. And the IRS isn’t sending money related to this plan.

Unless legislation passes, there will be no tariff dividend deposited to anyone’s bank account.

So Why Are People Seeing IRS Approves $2,000 Direct Deposit?

This is where things get real.

Thousands of Americans will see IRS deposits near or above $2,000 this month. But they come from these sources:

1. Tax Refunds

If you overpaid on your taxes in 2024, or filed recently, your refund may be processed in December 2025. According to IRS data, the average tax refund in 2024 was $2,148.

Refunds may include:

- Excess withholdings from W-2s

- Amended returns filed in fall 2025

- Refundable tax credits (more below)

2. Refundable Tax Credits

These credits are powerful because they pay even if you owe no taxes.

Examples of refundable tax credits:

- Earned Income Tax Credit (EITC): Up to $7,430 for 2024 tax year (varies by family size)

- Child Tax Credit (CTC): Up to $2,000 per child

- American Opportunity Tax Credit: Up to $1,000 refundable

If you claim these credits on your tax return, you may receive a sizeable deposit. For a family with two or three kids, this can easily push your refund near or above $2,000.

3. State-Level Rebate or Relief Programs

Some U.S. states have budget surpluses and run their own rebate programs — separate from the federal government.

For example:

- California issued “Middle Class Tax Refund” payments in 2022 and 2023

- Minnesota and New Mexico issued one-time tax rebates in 2023

- South Carolina gave out rebates up to $800 for qualifying residents

Each program has different eligibility rules, payment dates, and refund methods.

IRS Payment Processing Timeline – What to Expect

While there’s no $2,000 stimulus check from the IRS, you might still be due money. Here’s what affects timing:

- Filed recently? Refunds take 21 days or longer for e-filed returns

- Paper returns? These may take 6–12 weeks

- Amended returns? These are processed manually and can take 12–20 weeks

If you changed your bank, moved recently, or used a third-party tax preparer, your refund could also be delayed.

Common Mistakes That Delay Refunds

If you’re waiting for IRS money, avoid these common errors:

- Incorrect banking info

- Typos in Social Security Numbers

- Claiming credits you don’t qualify for

- Missing forms or signature on paper returns

- Amending returns too early

File clean and double-check your return before submitting. Professionals recommend using certified tax software or a licensed preparer to avoid costly delays.

Who Should Expect Money This December?

You might be among the folks who get a deposit this December if:

- You recently filed or amended your 2024 return

- You claimed refundable credits

- You’re due a refund from overpayment

- You qualify for a state rebate

- You updated your direct deposit info correctly with the IRS

How to Protect Yourself from Stimulus Scams?

When rumors go viral, scammers show up. The IRS has issued multiple alerts warning Americans not to fall for fake messages, emails, or calls promising “guaranteed $2,000” payments.

Here’s what to watch for:

- Fake IRS texts or emails

- Social media DMs claiming you need to apply

- Phishing websites mimicking IRS portals

- Requests for your Social Security number or bank info

The IRS will never:

- Call or email you to demand bank info

- Ask for gift cards to “verify identity”

- Send payments via third-party apps like Venmo or Zelle

$5,108 Social Security Payment in December: Check Eligibility Criteria & Full Payment Schedule

Federal $2,000 Deposit Expected in December 2025 – Only these will get it, Check Eligibility

IRS Sets December 18 Start Date for New $2000 Direct Deposit Payments