Missouri’s 2026 Minimum Wage Increase: The Missouri 2026 minimum wage increase is one of the biggest economic shifts the state has seen in years. Starting January 1, 2026, the statewide minimum wage will rise to $15 per hour, up from $13.75 in 2025. That may sound like just a few bucks more per hour, but for many Missouri workers, this is a life-changing raise — one that could mean the difference between just getting by and starting to get ahead. In this guide, we’ll walk through exactly what’s changing, who benefits, what the law says, and how both employees and employers can prepare. You’ll find facts, numbers, examples, and practical advice — all broken down in plain language.

Missouri’s 2026 Minimum Wage Increase

The Missouri 2026 minimum wage increase to $15/hour is a turning point — boosting pay for hundreds of thousands of workers and bringing the state in line with others that have modernized their wage standards. It’s a victory for employees who’ve worked hard through inflation and economic uncertainty, and a challenge for employers to adapt thoughtfully. While the repeal of automatic inflation adjustments and paid sick leave limits long-term benefits, the raise is still a powerful step toward fairer wages statewide. Whether you’re earning it or paying it, the best move is to stay informed, plan ahead, and keep the conversation about fair pay alive.

| Topic | Details |

|---|---|

| Effective Date | January 1, 2026 |

| New Minimum Wage | $15.00 per hour |

| 2025 Rate | $13.75 per hour |

| Tipped Employee Base Pay (2026) | $7.50 cash + tips (must equal ≥ $15/hour) |

| Public Employers | Must pay at least the state minimum wage |

| Inflation Adjustments After 2026 | Repealed under HB 567 |

| Paid Sick Leave Requirement | Repealed under HB 567 |

| Official Reference | labor.mo.gov |

The Basics — What’s Changing in 2026

Under Proposition A, approved by Missouri voters in November 2024, the minimum wage rose from $12.30 to $13.75 in 2025. The next scheduled step hits $15.00/hour on January 1, 2026.

For a full-time worker logging 40 hours per week, that means going from $550 to $600 a week before taxes — roughly $200 more per month in take-home pay depending on withholdings.

Originally, the law included annual cost-of-living adjustments tied to inflation and a statewide paid sick-leave requirement. But both were repealed in mid-2025 under House Bill 567, signed by Gov. Mike Kehoe.

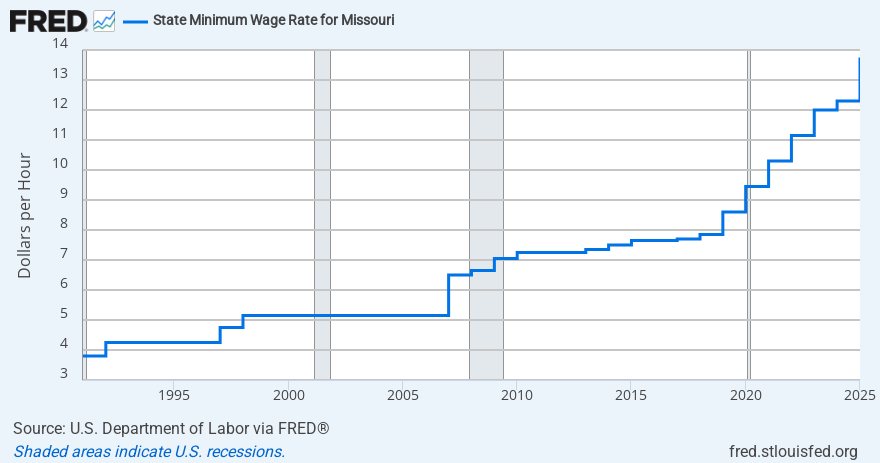

A Quick History of Missouri’s Minimum Wage

Missouri voters have consistently supported wage increases. In 2018, Proposition B started a phased plan that raised the wage from $7.85 to $12/hour by 2023. The latest move, Proposition A, approved in 2024, builds on that progress — reflecting growing support for higher pay among working families.

Over the past decade, the minimum wage in Missouri has nearly doubled. For comparison, the federal minimum wage has been stuck at $7.25/hour since 2009. That means Missouri workers at the new rate will be earning more than double the federal floor — an important benchmark for low-income households.

Who Benefits From the Missouri’s 2026 Minimum Wage Increase?

Low-Wage and Hourly Workers

According to estimates from the Missouri Economic Research and Information Center (MERIC), more than 560,000 Missourians earn below or near the new threshold. These include restaurant servers, retail clerks, janitors, caregivers, and many service-industry employees.

For them, a $1.25 raise might mean groceries without using credit, paying down medical bills, or saving for emergencies. A worker at $13.75/hour who moves to $15/hour and works 35 hours per week earns about $43 more each week, or roughly $2,236 more per year before taxes.

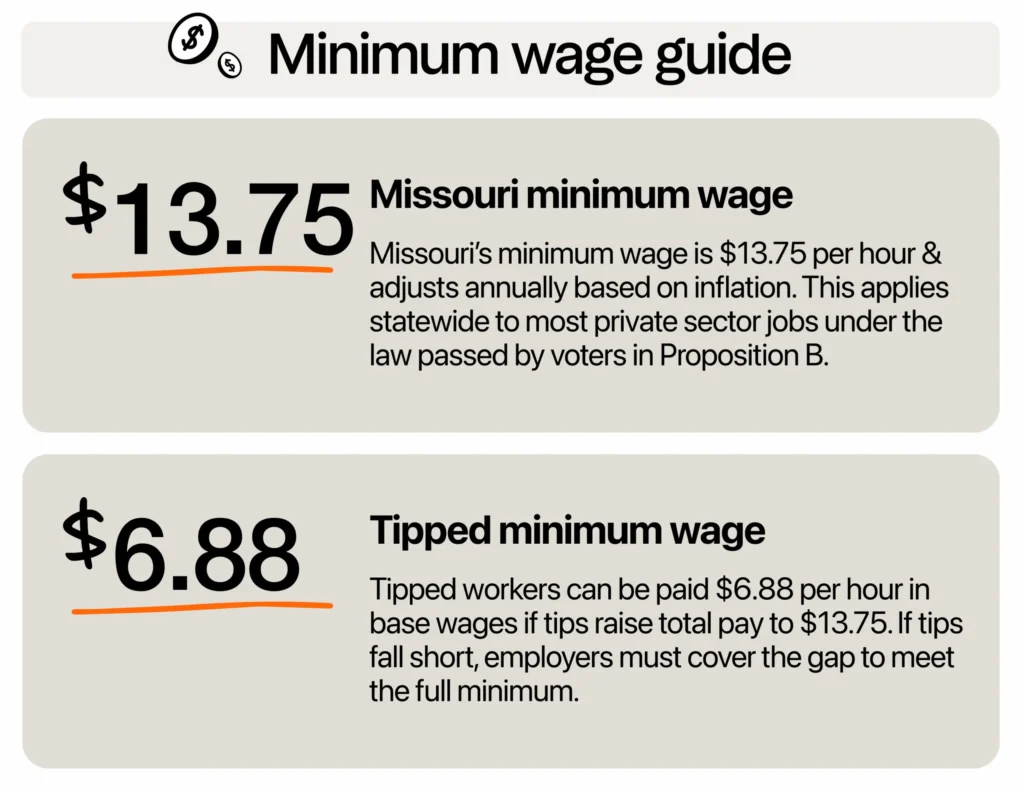

Tipped Employees

Missouri law allows employers to pay tipped workers half the standard minimum wage, provided tips make up the difference. So in 2026, the tipped base rises from $6.88 to $7.50/hour, and total earnings (wage + tips) must reach at least $15/hour. Employers must top up any shortfall. This rule affects thousands of servers and bartenders statewide.

Public-Sector Workers

A lesser-known part of HB 567 now requires public employers — like cities, counties, and state agencies — to follow the same minimum-wage standards as private businesses. That means school custodians, city clerks, and maintenance staff all receive the same protections.

Families

For two adults working full-time at $15/hour, annual household income reaches about $62,000 — roughly equal to Missouri’s median household income as of 2025. That extra income could help families afford better housing, transportation, and childcare.

What Employers Need to Know?

Businesses must update payroll systems and wage postings before the law takes effect. Employers with tipped staff should carefully track tip credits and make sure all employees meet the total wage floor.

It’s also smart to:

- Review budgets early to absorb labor-cost increases.

- Train HR and managers on compliance.

- Communicate with employees — letting them know when and how the raise applies builds trust.

- Document payroll adjustments to avoid disputes.

Small employers whose annual gross sales are below $500,000 may still be exempt, but they must comply with federal Fair Labor Standards Act (FLSA) rules.

The Cost-of-Living Reality

A $15 wage sounds good, but how far does it stretch? Data from the MIT Living Wage Calculator (2025) shows that the cost of living varies widely across Missouri:

| City / Region | Living Wage (Single Adult) | Difference vs $15/hr |

|---|---|---|

| St. Louis | $17.20/hr | − $2.20 |

| Kansas City | $16.90/hr | − $1.90 |

| Springfield | $14.30/hr | + $0.70 |

| Rural Missouri (avg.) | $13.60/hr | + $1.40 |

So, in smaller towns, $15/hour can exceed the local living wage; in urban areas, it still falls short of covering rent and healthcare costs. It’s a meaningful improvement but not a cure-all.

Comparing Missouri to Neighboring States

Here’s how Missouri stacks up in the Midwest wage landscape:

| State | 2026 Projected Minimum Wage | Status |

|---|---|---|

| Illinois | $15.00 | Similar to Missouri |

| Arkansas | $11.00 | Lower |

| Kansas | $7.25 (federal) | Far lower |

| Iowa | $7.25 (federal) | Far lower |

| Nebraska | $15.00 by 2026 | Similar |

| Oklahoma | $7.25 (federal) | Lower |

Regionally, Missouri joins Illinois and Nebraska at the top tier for base pay, making it more competitive for attracting workers, especially near state borders.

What Experts and Economists Say About Missouri’s 2026 Minimum Wage Increase?

Labor economists largely agree that moderate increases like Missouri’s help boost household spending without major job loss. Dr. Michael Podgursky of the University of Missouri notes that higher pay “reduces turnover, improves morale, and stabilizes local economies.”

Business groups, however, caution that employers with tight profit margins — like diners and small retailers — may need to raise prices or reduce hours.

A 2025 study by the St. Louis Federal Reserve found that previous minimum-wage hikes slightly raised consumer prices (by about 0.2%) but significantly improved worker retention and job satisfaction.

Real-Life Example

Take Maria, a cashier in Kansas City working 35 hours per week at $13.75/hour. Her gross pay is about $481/week. After the raise to $15/hour, she’ll earn $525/week — a $44 difference each week, or roughly $2,300 more a year before taxes. That could mean catching up on bills or saving for emergencies instead of living paycheck to paycheck.

For employers, that extra pay can also reduce turnover. According to the National Employment Law Project, replacing a low-wage worker can cost up to 20% of their annual salary. Keeping Maria happy is cheaper than replacing her.

Possible Challenges

- Inflation pressure: Since automatic CPI adjustments were repealed, the $15 wage might lose value if prices rise.

- Small-business impact: Rural shops and family restaurants may struggle to balance payroll with limited revenue.

- Wage compression: Workers already earning slightly above $15 may expect raises too, increasing total payroll costs.

- Reduced hours or automation: Some employers might trim hours or add self-checkout systems to offset costs.

Still, economists note that in states with similar increases, employment levels generally stabilize after a short adjustment period.

How to Prepare — Practical Advice

For Employees

- Check pay stubs in early 2026 to confirm compliance.

- Budget smartly — avoid lifestyle inflation and try to save part of your raise.

- Understand taxes — extra income may affect tax brackets or credits.

- Know your rights — report violations through the Missouri Labor Department.

For Employers

- Review payroll software for new rates.

- Communicate early with staff to avoid confusion.

- Audit tipped-employee records to verify total earnings.

- Plan pricing strategies if needed to offset rising labor costs.

Future Outlook — What’s Next?

Even though HB 567 halted automatic inflation indexing, advocacy groups such as Missouri Jobs with Justice are already drafting ballot language to reinstate it.

Nationally, the conversation is shifting toward a $20/hour standard in high-cost cities. If inflation continues, Missouri lawmakers may face pressure to revisit the issue before 2030.

Meanwhile, the repeal of mandatory paid sick leave may return to voters through a constitutional amendment. Several labor unions are collecting signatures to restore it by 2028.

Texas SNAP Payments Set for December 8–14 — Check Payment Dates and Eligibility Criteria

VA Cremation Payouts Revealed: How Much Can Your Family Really Get?

IRS Sets December 18 Start Date for New $2000 Direct Deposit Payments

Why It Matters — A Professional and Personal View

Having worked with employers and employees across Missouri, I’ve seen firsthand how minimum-wage changes ripple through communities. When workers earn more, they spend more locally — buying groceries, fixing cars, and supporting small businesses. That keeps money circulating within Missouri towns instead of leaving the state.

At the same time, business owners worry about rising costs. The key is planning — not panic. Many small shops adapt by adjusting hours slightly, cross-training staff, or improving efficiency. Over time, the economy adjusts, and most sectors see stability return.

The $15/hour rate doesn’t guarantee comfort, but it sets a stronger foundation for working families to build on.