Walmart has unveiled its best Christmas tree deals of the year, reducing prices on artificial and pre-lit models as holiday shopping accelerates across the United States. The retailer announced the cuts in early December to reach families balancing seasonal spending with rising household costs. Retail analysts say the strategy reflects fierce competition among major chains aiming to hold or expand market share during the most critical shopping period of 2025.

Best Christmas Tree Deals

| Key Fact | Detail / Statistic |

|---|---|

| Expected U.S. holiday spending | $966 billion in 2025 |

| Average retail holiday discount rate | 34%, highest in five years |

| U.S. households using artificial trees | About 75% |

Independent retailers are also offering targeted promotions, though their pricing structures differ widely based on regional demand and supply arrangements. As the season progresses, analysts expect additional markdowns from major chains as they balance inventory levels with end-of-year sales targets.

A Strong Seasonal Push as Retailers Navigate Shifting Consumer Demand

Walmart’s new pricing strategy arrives at a time when many U.S. consumers are adjusting their holiday budgets. According to Deloitte’s 2025 Holiday Forecast, discretionary spending remains stable but cautious. Inflation has eased compared with peak levels in 2022 and 2023, yet households continue to experience higher costs for food, utilities, and travel.

Dr. Laura Wren, a retail economist at the University of Michigan, said these consumer trends are reshaping holiday marketing strategies. “This year’s pricing structure shows how determined retailers are to win early-season traffic,” she explained. “Large-format stores are relying on categories like holiday décor to draw customers who may then purchase other goods.”

Walmart’s collection includes full-size artificial pines, narrow trees for small spaces, and pre-lit models with energy-efficient LED bulbs. Many products feature price reductions between 20% and 50%, depending on store location and inventory levels.

What’s Behind the Steeper Holiday Discounts?

Higher Inventory Volumes

Seasonal inventory levels rose this year as retailers adjusted to more predictable global shipping conditions. A Walmart buyer involved in the seasonal department said inventory for artificial trees increased by a “mid-single-digit percentage” over last year. Higher volumes often create downward pressure on pricing if demand does not match forecasts.

More Stable Global Supply Chains

Artificial trees are largely manufactured in China, Vietnam, and Mexico. According to the U.S. Department of Commerce, shipping times and freight costs have stabilized compared with the disruptions seen in 2021–2023. As a result, retailers entered the holiday season with products delivered earlier and at more predictable costs.

Competitive Pressure From Online Marketplaces

Amazon and several specialty décor retailers launched holiday promotions weeks earlier than in past seasons. Andrew Colin, a senior retail analyst at Forrester, noted that faster online comparison shopping encourages traditional chains to match digital discounting. “The competitive cycle is tightening,” he said. “Shoppers now check prices across multiple retailers before buying large seasonal items such as artificial trees.”

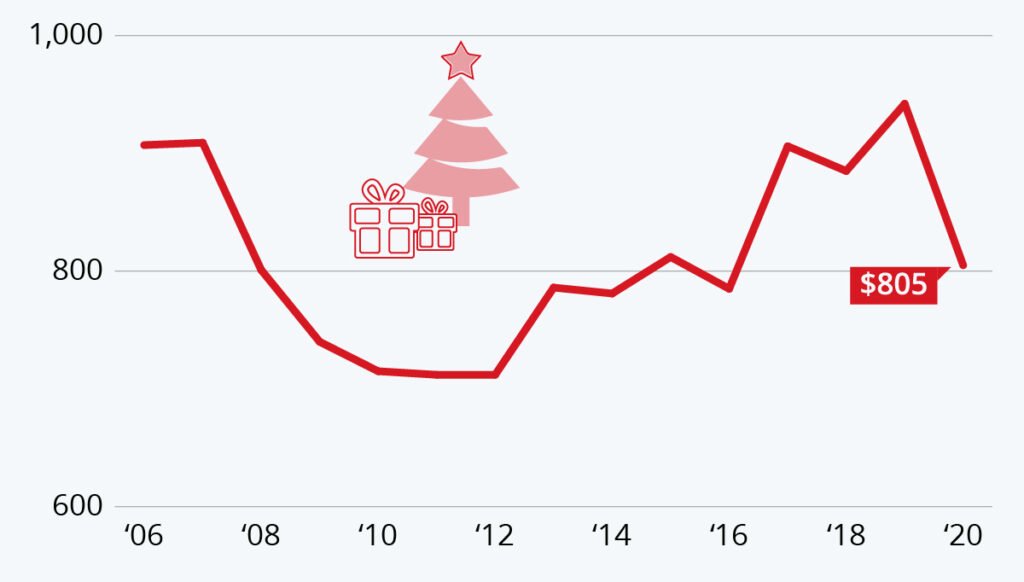

Historical Trends: How Artificial Tree Prices Have Shifted Over Time

Artificial Christmas tree prices rose sharply during the height of pandemic-related supply chain disruptions. The American Christmas Tree Association reported average wholesale cost increases of 20–25% in 2021 and 2022. Prices began to stabilize in late 2023 as supply chains recovered.

In 2025, analysts say prices are returning closer to pre-pandemic levels, though still slightly above 2019 averages due to higher material and labor costs in manufacturing regions.

Walmart’s current discounting levels suggest a deliberate effort to accelerate this correction and reestablish value-driven seasonal shopping patterns.

Environmental Considerations Shape Consumer Decisions

Artificial trees appeal to consumers seeking long-term reuse. A study by Quantis International, an environmental research firm, found that an artificial tree used for at least five years can reduce environmental impact compared with purchasing a fresh tree annually. But the findings vary by region, transportation distance, and disposal methods.

The National Christmas Tree Association, which represents natural tree growers, notes that real trees are biodegradable and support local agriculture, but artificial models remain the majority choice for U.S. households because they are convenient and require no seasonal maintenance.

Environmental factors now influence marketing campaigns from Walmart and other major chains, particularly among younger shoppers who consider carbon footprints when making purchases.

Regional Differences in Walmart Christmas Tree Pricing

Promotional pricing varies depending on supply levels and regional sales trends. Heavily populated markets such as Texas, Florida, and California often receive the deepest discounts due to higher inventory distribution. Smaller markets may experience narrower price reductions but greater availability of specialized tree designs, such as slim-fit or flocked styles.

Retail analysts say these variations are typical in seasonal décor, where weather patterns, local traditions, and demographic trends influence demand.

How Walmart’s Deals Compare With Other Major Retailers

Target, Home Depot, Lowe’s, and Costco also introduced holiday décor promotions early in the 2025 season. However, Walmart’s price range remains among the most accessible for mass-market shoppers.

- Target tends to offer fewer large discounts but emphasizes design-focused collections.

- Home Depot promotes premium trees with advanced lighting functions.

- Lowe’s features region-specific deals, particularly in Southern markets.

- Costco focuses on high-end, long-lasting models, typically in fewer styles.

Adobe Digital Insights reported that Walmart recorded one of the strongest increases in web searches for Christmas tree pricing this December, indicating high consumer interest.

Consumer Behavior: What Shoppers Are Prioritizing in 2025

Pew Research Center found that more than half of Americans are moderating holiday spending due to food, housing, and energy costs. This trend is pushing families to prioritize durability, energy efficiency, and total lifetime value when selecting holiday décor.

Dr. Emily Saunders, a consumer psychology researcher at Ohio State University, said shoppers are “weighing practicality more heavily than in previous holiday seasons.” She added, “Shoppers prefer products that last multiple years and use less electricity. Pre-lit trees with LED bulbs are becoming the dominant choice.”

A Buyer’s Guide: How to Evaluate Artificial Christmas Trees

To help shoppers assess the deals, experts recommend considering several factors:

Height and Space

Measure ceiling height and room size. Standard living rooms accommodate trees between 6 and 7.5 feet.

Branch Tip Count

Higher tip counts provide fuller branches.

A typical high-quality 7-foot tree includes 1,500–2,500 tips.

Lighting Type

Pre-lit models with LED technology use less energy and last longer than incandescent bulbs.

Material Quality

PVC trees are common and lower-cost, while PE trees offer more realistic branch textures but higher prices.

Storage Requirements

Consider whether the base, branches, and lighting system allow for compact off-season storage.

Expert Outlook: What Analysts Expect for the Rest of the Season

Retail analysts predict that competitive discounting will continue until Christmas Eve. If inventory levels remain high, additional markdowns may appear in mid- to late December.

Dr. Wren of the University of Michigan anticipates modest revenue growth for large retailers: “Consumers are still spending, but they are more selective. Strong promotional activity will likely support steady sales, but margins will remain tight.”

Moody’s Retail Insights echoed this view in a recent briefing, noting that aggressive discounting may affect profitability but will strengthen customer loyalty going into 2026.

The Broader Retail Landscape: What Walmart’s Strategy Signals

Walmart’s approach provides insight into the broader retail environment:

- Discount cycles are starting earlier.

- Seasonal décor is emerging as a key competitive category.

- Large players are testing dynamic regional pricing models.

- Greater reliance on e-commerce data is shaping in-store promotions.

Retailers now blend online analytics with traditional merchandising to adapt quicker to localized trends.

FAQ

Are Walmart’s artificial trees high quality?

Quality varies by model. Many mid- and upper-tier trees include realistic PE tips and durable LED lighting, features noted by consumer review groups.

Do prices differ online and in stores?

Yes. Online prices may change more frequently due to digital demand tracking. Some in-store clearance deals are exclusive to specific locations.

When do the steepest discounts usually appear?

Historically, the largest markdowns occur between December 15 and December 24, depending on inventory levels.

Do these deals include warranties?

Most pre-lit trees include a limited manufacturer warranty, though coverage terms vary.